Is Zelle Safe To Receive Money From Strangers?

Is Zelle safe to receive money from strangers? This article explains everything about Zelle app, as well as whether or not it is safe to receive money from strangers using Zelle.

What is Zelle?

Zelle is a digital P2P financial app that makes it easier to transfer and receive funds from colleagues and relatives.

Individuals may now transfer funds quite easily without having to carry large amounts of money thanks to Zelle.

Zelle is supported by a large number of financial institutions and transferring funds across accounts usually requires just a few minutes.

You may use Zelle to buy items anywhere you go without having to carry around a credit card.

In 2019, customers of Zelle moved approximately $187 billion, making it among the financial technology applications with the largest sums of money in operation.

Nevertheless, there are numerous frauds occurring on Zelle, leading some individuals to wonder if it is secure to receive payments using Zelle.

Even though Zelle has established itself as among the most secure payment platforms, there are still those who resort to dishonest means of exploitation, such as hacking victims’ accounts to trick them into sending cash.

Nevertheless, in this article, we’ll talk about whether it’s secure to use Zelle to receive money from random people.

ALSO READ:

Does Walmart cash handwritten checks?

Is Zelle Safe to Receive Money From Strangers?

All that is needed to receive payments from other individuals is your Zelle email address. It is secure to receive funds from strangers on Zelle because this does not reveal any sensitive data about you.

Nevertheless, it is not viewed as secure to use Zelle to transfer funds to strangers due to the numerous frauds taking place, and it is advisable that you exercise caution when using Zelle to transfer funds to strangers.

Stop transferring funds to strangers if you want to prevent falling victim to a fraud. Transfer funds only to those you have connections with.

Nevertheless, if you receive funds from a stranger, you can submit the transaction to the Zelle support staff.

Is It Possible to Be Scammed If a Person Transfers Funds to You?

If a person transfers you funds via Zelle or another payment network, you could suddenly become the victim of fraud.

When fraudsters use your phone number and email address to receive funds from their clients, they could then call you to let you know that the funds was transferred in error and then ask for a return into their account.

Nevertheless, you can be accused of fraud if the client informs his bank about the incident.

Submit any unauthorized payments to the proper authorities or the Zelle support staff for assistance in order to stay secure always.

3 Popular Zelle Scam Formats You Should Be Aware Of

Notwithstanding Zelle’s security measures, frauds still happen. As a user, you must keep an eye out for unusual behavior such as these three typical scam formats:

False Text or Email Claimed to Be From Your Bank

A text message from your bank requesting you to verify that you performed a certain payment and requesting you to reply “yes” or “no” as to whether it is real may be the beginning of a scam.

Majority of Zelle frauds are fairly straightforward: You could get a text message regarding a transfer of funds that you clearly didn’t approve.

The fraudster then waits for you to reply and assumes the position of a bank official, and afterwards deceives you into divulging sufficient private and banking details to carry out the money transfer.

We advise that you should not tap any link in a text message or email. To find out if your bank account has been hacked, contact your bank immediately.

False Call from the Theft Protection Team

Not long ago, a lady from New Jersey reportedly shared her experience on how she was defrauded of $1,000 after getting a call from a person posing as a member of her bank’s theft protection team to inquire about a pending payment.

She stated that the call appeared very real to the extent that the caller ID on her phone was displaying the correct name and phone number of her bank.

The lady went further to narrate how the scammer told her that she need to check her PNC Zelle app to cancel the unapproved payment before it was processed.

The lady said that the scammer handed her a code to input, and instructed her to input her first name and surname and write “reversal” on the Zelle memo.”

The lady said she did as instructed by the scammer and that was how she was scammed.

False Call from a Utility Agency

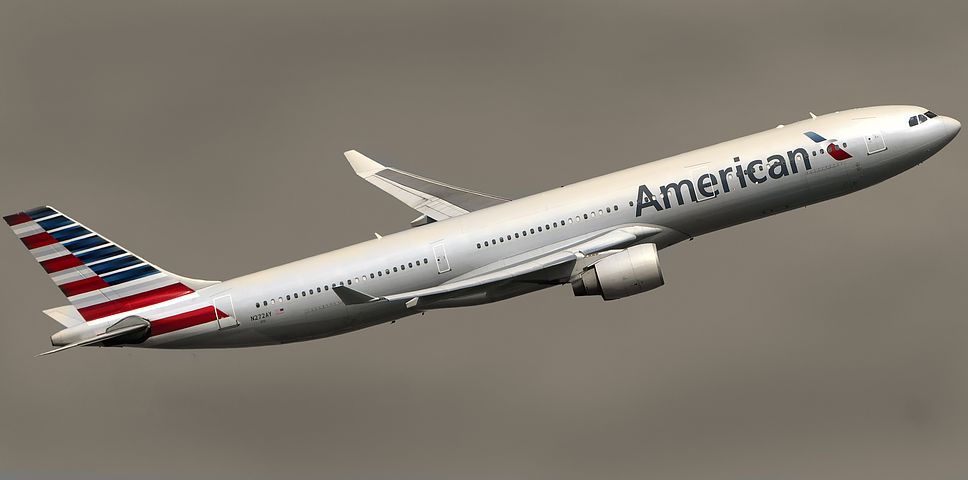

Another lady from a Cleveland area, sometime in April also spoke about her experience with the Zelle scam.

She recounted how she got a call from what she believed to be her utility agency, warning her that she had just 30 minutes to cover the cost for her bill before her electricity will be shut down.

According to the lady, the scammer she talked with advised her to pay the funds using Zelle because the scammer was familiar with her account information, such as her location and the outstanding balance.

She further narrated how the scammer had given her directions on how to send the $295.64 utility bill that she owed, however that the first effort had run into trouble.

According to her, the second and third attempts also didn’t go through. So the scammer then handed her a security code for the fourth attempt.

After everything, funds were taken out of her account in all of the four times, but instead of coming to the utility agency’s account, over $1,200 went to the scammer’s account.

ALSO READ:

How to load cash app card at 711?

Can I cash out my 401k while still employed?

What is the median salary of a cybersecurity engineer?

How Can I Prevent Being Scammed On Zelle?

- To avoid fraudulent login to your account, constantly implement safety checks to your financial mobile apps, such as Zelle.

- Prior to transferring any funds, constantly check the request for payment with the individual via phone calls or emails since fraudsters can hijack accounts to defraud you.

- Do not transfer funds to strangers. Transferring to strangers should be avoided due to the numerous frauds taking place.

- Never lend your smartphone to a stranger since they could simply log into your Zelle account and begin moving money.

Does Zelle Display Your Name When Transferring Funds?

Whenever you use your account to initiate a payment, Zelle displays the complete name you submitted when opening a Zelle account.

The beneficiary can be able to tell who is transferring the funds because your name will be listed in the transaction records.

Nevertheless, Zelle discloses both your username and complete name in the transaction records, whereas most P2P networks just show your username.

What are other Options to Zelle?

We cannot advise making a first payment with Zelle. We advise that you utilize services such as PayPal when transacting funds with an individual for the first time.

Although the charges are horrendous, PayPal provides a significantly wider security net.

You can start using Zelle for the ease of fast money transactions when you have built up a rapport of confidence with this individual.

The following is a list of other alternatives to Zelle:

Google Pay

While it’s less popular than applications such as Venmo and PayPal, Google Pay is the standard payment method on several Android smartphones.

However, it’s a simple method to send funds to colleagues and relatives without having to incur any charges, and it works with a variety of Google products, services, and applications.

Venmo

Venmo, which styles itself as a kind of public payment application, lets you view what your colleagues and relatives are doing on your phone while simultaneously allowing you to make confidential payments too.

Dividing expenses using Venmo is simple, however there is a 3% fee if you utilize your credit card with Venmo.

Cash App

Square’s online transaction application is fairly comparable to Venmo, although it doesn’t have social functions such as the option to view how your colleagues and relatives are using their funds.

Despite being among the rare applications that natively accepts cryptocurrencies, it additionally has a 3% charge for credit card payments.

PayPal

PayPal is among the first p2p online payment applications in the world and offers no charges for transferring funds between colleagues and relatives.

However, the costs associated with buying products and services using Paypal are quite substantial.

It is very essential to note that Paypal provides minimal security when making online purchases of products and services.

Conclusion

Thank you for reading this article on “is Zelle safe to receive money from strangers.”

Receiving funds from random people is quite secure on Zelle. This was stated explicitly on the Zelle blog article.

Only transfer funds to persons you have a relationship with because it is not secure to transfer funds to complete strangers with Zelle.