Does Truebill Cost Money?

Does Truebill cost money? This article explains everything you need to know about Truebill, as well as whether Truebill cost money.

These times, keeping track of all of your subscriptions and everyday expenses can be daunting.

Sometimes, you subscribe for a streaming program or online publication subscription that you hardly ever make use of.

Applications like Truebill were developed to address this issue. This financial and cost-control application gathers the whole of your monthly costs in a single location to make it easier for you to stay in control of your expenditures.

Additionally, it offers a bill negotiation tool that might help you cut costs on recurring bills such as smartphone and internet services.

However if you desire the majority of Truebill’s features, you must pay for it. Truebill does cost money only if you wish to use its premium version.

ALSO READ:

Does Big Meech still have money?

Is Zelle safe to receive money from strangers?

What is Truebill?

Truebill is a cost-control and financial tool that aids customers in keeping track of their recurring monthly expenses.

With its freemium plan, you may take advantage of certain fundamental budgeting and subscription control tools at no cost.

However, you must pay for options like bill negotiation, increased budget flexibility, and many more.

Three brothers named Yahya, Haroon, and Idris Mokhtarzada, established the firm in 2015, making it the most recent of their joint endeavors since they were young.

Yahya Mokhtarzada claimed in a June 2021 interview with Forbes that the idea of the firm came on a certain day the brothers were discussing about paying for subscriptions they had forgotten they bought.

Truebill was established as a result of that discussion, and according to Forbes, Truebill has a worth of over $500 million.

Both Apple and Android devices can download the application. According to its website, Truebill has over 2 million users currently.

Not less than one million subscriptions have been terminated, thereby helping customers cut cost of more than over $100 million.

Does Truebill Cost Money?

Truebill Premium has a monthly price range of $3 to $12, and its “pay-what-is-fair” pricing structure lets you decide the amount you want to pay.

In contrast to other sums that bill you every month, if you choose $3 or $4, you pay yearly.

Accordingly, the price of Truebill Premium might range from $36 to $144 every year, depending on your level of benevolence.

Additionally, you pay anywhere from 30% to 60% for effective bill negotiations. Once more, you get to choose the amount you wish to pay.

The application has a free version, but we don’t think it has enough budgeting functions or customization settings that are very helpful.

Additionally, if you’re prepared to invest the effort, you are free to constantly contact service suppliers to bargain for lower pricing or terminate subscriptions on your own.

How Truebill Functions

Truebill is a budgeting application with many functionalities to assist you in monitoring and lowering your expenses.

In order for Truebill to track your spending and assist you with budgeting, you must first link your multiple bank accounts to Truebill.

Additionally, the application keeps account of your monthly subscriptions, ensuring that you always understand precisely what you’re subscribing for.

ALSO READ:

Does Walmart cash handwritten checks?

Truebill Subscription Control

The subscription tracking tool offered by Truebill is among its primary free services.

The application recognizes subscriptions and groups them into a table of regular expenses when your bank accounts are linked to the application.

These subscriptions could range from a Netflix or Hulu subscription to your gym subscription.

All of your subscriptions are conveniently arranged under a single section, making it easy to keep track of your monthly expenditures and prevent the lapse of any unused subscriptions.

Additionally, premium Truebill users are free to contact the concierge crew to terminate their subscriptions on their behalf.

On its website, Truebill claims to have already terminated more than a million subscriptions for its users.

However, free users are not prevented from handling terminations on their own to maximize savings.

Truebill Bill Negotiation Feature

An additional premium service that Truebill offers is bill negotiation. The bulk of the top cable, house protection, and telephone companies are partners with Truebill, and Truebill can get in touch with them to negotiate for cheaper prices for you.

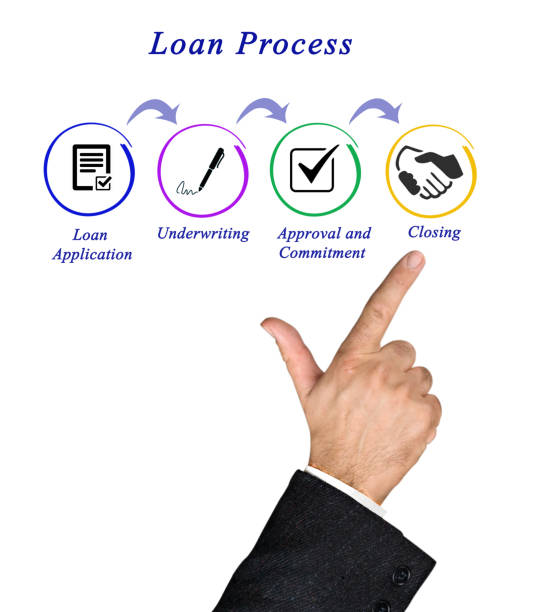

The whole procedure, according to the firm, results in bill negotiations that are effective up to 85% of the time and it involves four stages:

- Pick a bill: Pick the bill that Truebill should negotiate.

- Link your bill: By inputting your user information or providing an image of your monthly billing notice, you can attach your bill to your Truebill account.

- Specify your choices for negotiations: This covers confidential details and your readiness or reluctance to give up services or not to cut costs.

- Verify the payment option and sum: If Truebill reduces your bill, it will cost you between 30% and 60% in yearly savings. You are permitted to use either debit or credit card to settle this charge, and you are free to decide the amount to pay.

The point at which Truebill becomes a little hazy is with the payment aspect of bill negotiations.

Basically, Truebill assesses an advance costs that ranges from 30% to 60% of your yearly savings.

For instance, you would save $240 a year if Truebill reduced your AT&T internet subscription from $80 to $60 each month.

Then, you are required to pay Truebill 30% to 60% of the yearly savings which is around $72 to $144 in this instance.

Although this is an advance cost, you will cut costs over the duration of the year and enjoy reduced monthly bills as a result.

Truebill Budgeting Resources & Spending Insights

The two key elements that set Truebill apart from other applications are Truebill’s subscription tracking and bill handling.

However, it additionally provides resources for monitoring your expenditures. The spending insights page displays information about your monthly expenditures, earnings, the number of bills you need to pay, and the amount of remaining free expenditure.

Additionally, you receive budgeting features that resemble those seen in applications such as Mint and YNAB.

Truebill dynamically classifies costs and emphasizes your buying habits once you link your bank accounts in order for you to see the areas you could be unnecessarily lavishing too much money on.

This might be your leisure budget, or perhaps you are excessively lavishing money on food items every month.

In order to assist, Truebill additionally develops “spending allowances” that you can adhere to prevent excessive lavishing of money.

The application also has a feature for monitoring your net worth that lists your principal investments and debts.

It’s akin to apps such as Personal Capital and Kubera because you are free to personally input investments and debts too.

Please be aware that the free edition of Truebill has limitations such as the inability to establish an infinite number of budgets or unique budget sections.

This is why Mint is recommended above Truebill or other Mint options if you only need assistance with your spending patterns.

Advantages of Truebill

- Gathers the whole of your recurring expenses and subscriptions into a single interface.

- Monitor the growth of your income.

- Track your monthly buying patterns to identify areas where you might be unnecessarily wasting money.

- Facilitates the discovery of unused subscriptions

- Offers expert bill negotiation services

Disadvantages of Truebill

- You must pay for Truebill premium in order to access the majority of its services.

- You must pay for effective bill negotiations even when you have paid your monthly subscription cost.

- There are various procedures to terminate Truebill Premium.

- Free users cannot sync their accounts in real-time.

How Secure Is Truebill?

Truebill employs a number of safety measures to protect the privacy of your private and financial data.

For instance, it doesn’t save your bank login credentials. Rather, it utilizes Plaid, a well-known platform for connecting financial information that is utilized by several other FinTech applications.

Additionally, every data between Truebill and your accounts is secured. Generally, this shows that Truebill is a secure application to try out.

You are free to send an email to security@truebill.com if you have any inquiries concerning Truebill’s safety.

How Reliable Is Truebill?

Truebill is a reliable application since it aids in keeping track of your monthly expenses and subscriptions.

Additionally, if you choose to pay for Premium, its crew will try their best to negotiate lower prices on your behalf.

Nevertheless, there are a lot of things about Truebill that we don’t like. To begin with, you must pay for this application in order for it to be truly beneficial.

However, some free budgeting applications provide significantly better customization options than Truebill’s free version.

Additionally, once you register for Premium, you may encounter a lot of hurdles if you eventually choose to quit paying for it.

Truebill has its official rules for terminating premium subscriptions. To terminate a Truebill Premium subscription, simply refer to Truebill’s official rules.

If you are unable to terminate your premium subscription because of any reason, you can speak with a specialist to assist you.

Furthermore, terminating your subscription does not stop your Smart Savings account or any current bill negotiation applications.

You must undergo two or three termination procedures in order to actually exit the Premium part.

From our observations, although Truebill is reliable, we do not believe Truebill is cost-effective at this moment.

Keyword: Does Truebill cost money

Conclusion

Thank you for reading this article on “does Truebill cost money.” The free Truebill application is incredibly beneficial if you need assistance in keeping track of your regular expenses and subscriptions.

You will not be dissatisfied with the free budgeting alternatives if you don’t worry a great deal regarding comprehensive budgeting features and customization.

Nevertheless, if you want greater customization options and features such as subscription terminations and bill negotiation, you truly need to pay for Premium.

But from our all-round observations, the cost at this moment is not justified by these qualities.

There are far a lot of free options available, and all significant savings are offset by the additional monthly cost you must pay to negotiate your bills.

Also, if you don’t have enough cash on you at the moment, contacting bill suppliers directly and utilizing free budgeting applications are better economical options.

Kindly note that Truebill has both a free and a premium version. If you want to get the most out of Truebill, you may have to pay for the premium version.