How Do You Avoid Paying Pesky ATM Fees?

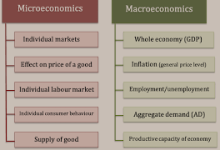

ATM fees average around $3. However, some machines may impose higher surcharges up to $5. Illustration by Ken Lyons/The Penny Hoarder

Are you averse to ATM fees? You’re not the only one who hates ATM fees.

It is annoying to pay money to access your money.

ATM fees average around $3. However, some machines may charge $5 or more.

Many non-bank ATM operators charge more than banks, sometimes charging up to $10 per transaction. For example, Las Vegas casinos are known for charging high ATM withdrawal fees.

It may seem small to pay a couple of dollars here and there, but it can add up quickly. If you have a tight budget, those little charges can add up.

Avoid pesky fees by visiting your bank and sticking with in-network ATMs. Some financial institutions will reimburse you for certain ATM fees per month, or per year.

If you need money to send to friends, you can ask for cash back at the register.

ATM fees can sometimes be unavoidable, especially when you are traveling or have limited time.

ATMs can also make money for the businesses hosting them. Some establishments make it easy (but costly) to use them. You may have been to a restaurant or bar that accepts cash but has a high-fee ATM a few feet away.

The Penny Hoarder Community is conducting a survey to find out how members can avoid ATM fees.

Respondents favor staying in-network and planning ahead to avoid any unwanted charges.

There have been more than 1,350 participants, but you can still share your thoughts. To cast your vote now before August 10th, head to The Penny Hoarder Community.