Why Hasn’t Venmo Taken My Money From My Bank Account?

Why hasn’t Venmo taken my money from my bank account? Venmo made about $850 million in earnings in 2021 with over 60 million users.

These figures can lead you to naively give your bank account information to a mobile payment application. Up to a time when a transaction fails to go as planned for you.

Therefore, why hasn’t Venmo taken my money from my bank account?

There are some explanations for why Venmo did not deduct funds from your bank account following a payment.

It might just be a little lag brought on by Venmo’s vetting procedure. Other factors could be unconfirmed bank accounts, illegitimate recipient accounts.

In today’s post, we shall outline the numerous remedies you can take to address the root causes of this problem.

ALSO READ:

Can you add money to Venmo card at ATM?

Does chime show pending deposits?

Why Hasn’t Venmo Taken My Money From My Bank Account?

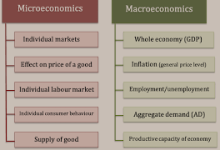

The standard transfer procedure offered by Venmo is cost-free. Nevertheless, to guarantee safety, the transfer is reliant on three sides which are Venmo’s associate, your bank, and the Automated Clearing House (ACH).

The lengthy screening procedure in Venmo is what causes the frequent lags. The app’s users have transfer problems more frequently than you’d expect.

However, the following are potential reasons for the problem and their recommended remedies.

You Started a Standard Transfer

Standard transfers require 1 to 3 working days. Venmo speeds up instant transfers by handling them via a separate channel.

Instant transfers usually take 30 minutes to process. Nevertheless, you’ll need to wait three working days before detecting an issue if you have previously started a standard transfer.

You Started the Transfer on a Weekend

A standard transfer that you make on the weekend will start the following working day.

Keep in mind that making the transfer beyond 7 p.m. ET may result in further delays.

Also, if you start a transfer shortly before a holiday, it will take an extra day to complete.

All you have to do now that the standard transfer has started is to exercise patience till the extra days for it to finish.

Nevertheless, you should select instant transfers when next you want to so transfer so it can start right away on weekends and bank holidays.

You Are Examining the Specifics of a Different Bank Account

This could occur if you’re sleep deprived, however it can equally apply to people who have numerous Venmo or bank accounts.

Examining which Venmo account is connected to a bank account will suffice in this situation.

You Neglected to Confirm Your Bank Account

In order to be certain you submitted the appropriate bank information, Venmo highly advises confirming your bank account prior to sending any money.

The transfer will undoubtedly not go through if the incorrect data were provided.

In this instance, your bank could eventually transfer the funds back to your Venmo account.

Or, it’s possible that your money will disappear, and Venmo won’t be liable for it.

The refund of transferred funds by your bank is not assured by Venmo. You must thus speak with your bank and clarify the situation.

You Have an Invalid Bank Account

Verify the Venmo app to see if your bank account has been designated as “invalid.”

This indicates that lately, Venmo was unable to withdraw or transfer money into that account.

That particular bank account will likewise be designated “invalid” for any additional Venmo users that utilize it.

There are various causes for this to occur:

- Your bank account was unable to be confirmed

- Your bank informed Venmo that they were unable to locate your account

- Your bank account is ineligible for ACH transactions or online payments (usually for savings accounts)

- Your permitted transactions have been outpaced

You must get in touch with your bank to find out the condition of your account in the initial three situations.

You might just have to re-enter the right bank account information if your account is not limited. If not, you can make use of another card or bank account.

Your Transaction Is Pending in the App

If your payment was sent to an email or phone number that is not associated with an existing Venmo account, it may be flagged as “pending” or “incomplete.”

To fix this problem, tell the beneficiary (maybe your colleague) to confirm their phone number or email address.

Alternatively, they could include your email to their Venmo account. Simply select “Take Back” from the app to reverse the payment. The money will be deposited into your account in not less than 3 days.

Your Instant Transfer Was Rejected

For a number of causes, notably Venmo’s computerized safety measures, instant transfers may be rejected.

Confirm that your name is on your card and that your official first and surname are listed in your Venmo account prior to initiating an instant transfer.

Just know that the instant transfer service is not currently functional at that time if the problems continues.

The Venmo technical department is unable to step in at this time. As a result, initiating a standard transfer is all you have to do.

Another Transfer Date Could Be Visible on Your Bank Statement

Because of a few delay, a transaction may occasionally appear on another date on your bank statement.

Your job this time around is to review the related dates on the statement.

Your User Account Has Been Targeted by Venmo

Venmo may have detected erroneous or questionable behavior on your account, such as unintentionally accepting money from a fraudulent card.

Venmo may thus take a number of significant measures against your account, such as terminating it or suspending your money.

You can contact Venmo’s customer service department if there is a dispute. However, you might be asked to submit further details to confirm your authenticity.

ALSO READ:

What bank can I withdraw money from my Emerald card?

Advantages and Disadvantages of Venmo

Venom, just like every other mobile transaction app has numerous pros and cons. Let’s look in to some advantages and disadvantages of using Venmo.

Advantages of Venmo

The following are some primary advantages of using Venmo:

- Venmo has no recurring or yearly charges

- You can utilize Venmo for both in-person and online transactions

- Venmo offers debit and credit cards with the Venmo logo

- You are free to retain a cash balance in Venmo account

- The social media elements on Venmos can be attractive to certain customers.

Disadvantages of Venmo

Venmo has the following main disadvantages:

- Venmo imposes various service charges

- Except if you change your security settings, your security might be jeopardized

- Funds are sometimes inaccessible until a charge has been paid

- Inability of receiving interest on funds transferred via Venmo

Is It Secure to Use Venmo

Venmo is a fairly secure app to use, despite the fact that transferring funds via an app may appear irresponsible.

This is due to the fact that your account details is protected by data encryption technology, which prevents unauthorized parties from using your credit card or bank account.

If you desire an additional level of safety, Venmo offers customers the chance to create a PIN number for signing in, and also a fingerprint scan feature for smartphones that support it.

Customers must constantly be mindful that there is a chance of a data leak with every online or mobile transaction.

Because of this, it’s a good idea to move significant sums of cash to a connected bank account rather than keeping them in your Venmo app.

Furthermore, prior to sending cash, you should ensure that you are familiar with the recipient.

Conclusion

Thank you for reading this article on “why hasn’t Venmo taken my money from my bank account?”

We advise applying the solutions in this article any time you experience similar transfer problems.

Venmo does not deduct funds from a bank account for several reasons. A few are humorous, while others are very somber.

Start by checking the app to see how your transfer is progressing. After that, make sure you’re using the correct bank account and exercise patience for a few days before checking your bank statement once more.

Verify the condition and specifics of the bank account you supplied for Venmo if the problem continues.

Venmo won’t frequently be capable of undoing its computerized procedures.

Your safest course of action is to double-check your information prior to initiating a transfer.