How to Deposit Cash with USAA? (Complete Guide)

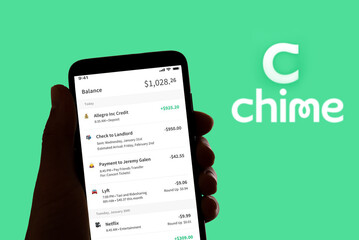

How to deposit cash with USAA? USAA provides a range of banking services, including credit cards, car loans, and mortgages.

Nevertheless, their online cash deposit feature is among their unpopular services.

This service allows USAA members to swiftly and simply deposit money into any of their accounts.

In today’s post, we shall discuss extensively on how you can deposit money with USAA. So read till the end!

ALSO READ:

Does Huntington Bank have Zelle?

What Is USAA?

USAA is a top financial service company that provides banking, investing and insurance options to people who work in the military and their households.

USAA was established in 1922 by a team of military personnel looking for financial security.

USAA, a top American insurance provider is famous for its top-notch customer support and assistance to individuals who serve the nation.

USAA is renowned for exhibiting an unrelenting dedication to its members, as well as winning multiple honors for great service, staff well-being, and financial soundness.

Currently, more than 8.2 million members are serviced by USAA. Only active military service members, their households, and their children have access to USAA’s financial services.

As long as you are U.S. military personnel, you are free to join USAA together with your household.

How to Deposit Cash with USAA?

The following are 4 primary methods you can deposit money with USAA:

1. Use an ATM to Deposit Money with USAA

If you are an USAA member, you are free to deposit your money at any ATM that supports Visa deposits.

Insert your card into the ATM machine, then choose Deposit after inputting your PIN.

In order to deposit money, select the account you wish to deposit money into, input how much you wish to deposit, and then complete the transaction.

The money will enter your account after a short while. Additionally, even if you don’t belong to USAA, you are still allowed to use this alternative if you have any of their credit cards.

It needs to be enabled over the phone or on their website. As soon as it is enabled, you are then permitted to use an ATM to make up to $5,000 in deposits each day.

To accomplish this, we advise printing out the form from their website ahead of time to ensure that all the data is set for you when you get there.

You can use your account at ATMs scattered across the country. Below the “Help” menu, choose “ATMs & Locations.”

On the map, you will view specifics about a location and the services it provides. To view every USAA branch nationwide, zoom the map in and out as desired.

Keep in mind, the only method to withdraw or deposit cash is by going physically to a USAA store or calling customer support if you aren’t using an ATM that takes Visa deposits for your transactions.

When going to your neighborhood location, it is usually advisable to go with any sort of identification with you for them to identify who you are and the reason you’re there.

2. Deposit Funds with USAA for a Money Order

Most often, a few dollars’ worth of charges are charged to create money orders.

Money orders are frequently capped at $1,000 in value, therefore if you want extra, you will have to buy a lot of them.

Money orders are available from Western Union, the post office, and some grocers such as Walmart.

For money orders that are granted by the military, the United States Postal Service charges a discounted rate of 45 cents.

The same rules that apply to checks also apply to money orders. You must designate yourself as the recipient of the money order for it to be deposited into your account.

Complete the form with your details, then sign your name as the one placing the order.

3. Use a Prepaid Debit Card to Deposit Money with USAA

When you connect your prepaid debit card to your USAA account, you are free to swiftly send cash from your card to your account using online transfer.

Your prepaid debit card can always be reloaded with money. Always ensure you evaluate many prepaid debit cards to select the one that offers the best convenient reloading procedure and the cheapest costs.

4. Direct Deposit

Direct deposit is among the best efficient methods to deposit money with USAA.

Your checking or savings account should be connected to your USAA account in order to accomplish this.

You can set up recurring deposits or initiate a single deposit after connecting your accounts.

Sign into your online banking account and select the Transfers option to create direct deposit.

Afterwards, you can include your USAA account as a recipient of money.

Then, select the regularity of the deposits (either per week, per month) and the time period (probably morning or evening).

Furthermore, you have some various account kinds to pick from, such as checking, savings, CD/IRA, and brokerage accounts. Choose Transfer to Third Party Account if you are making a deposit for another person, such as your partner or child’s savings account.

Ensure that kids below 18 are listed on the Subaccounts page if you want them to be able to use their funds when they become 18 years old.

Otherwise, when they become 18 they won’t be permitted to withdraw money.

The transfer is at no cost, and it typically requires five working days for the funds to appear in your account.

ALSO READ:

Does Walmart cash payroll checks?

Frequently Asked Question about “how to deposit cash with USAA?”

At Which USAA Branches Can I Deposit Money?

Money deposits are accepted at all USAA branches. Nevertheless, the following points need to be taken into account:

- You must ensure your account number is available.

- The teller needs to confirm your identity.

- You must complete a deposit slip.

- Every check you are depositing must be approved.

- You must verify that all of the cash you want to deposit is complete by counting it.

What Amount of Money Can I Deposit with USAA?

If you have a bank or savings account with USAA, you are free to deposit money whenever you want.

Signing into your account and choosing the “Deposit” option will allow you to swiftly make a cash deposit.

You will then have the choice of inputting how much money you want to deposit.

There is a daily cap on the amount of cash you are permitted to take out from your account, however there is no cap on the amount of funds you are free to deposit.

How Much Does It Cost to Deposit Money with USAA?

There are no costs applied when you deposit money with USAA. You can deposit funds to your account at any moment using this fast and simple method.

You can deposit an unrestricted amount of money, too. Therefore you are permitted to deposit any amount, no matter how big or little, without paying any costs.

At What Time Does USAA Branches Open And Close?

You must go to a nearby branch during regular hours of operation to deposit money with USAA.

The hours of operation for USAA differ depending on the region, though. Prior to embarking on any movement, confirm the opening times for each branch.

For instance, although certain branches can offer longer hours until 6:00 or 7:00 p.m., others might only be operational from 9:00 a.m. to 5:00 p.m. Using the USAA branch finder, you may verify it.

How Can I Deposit Money with USAA?

There are several ways you can deposit money with USAA. You are free to deposit funds at any ATM that supports USAA deposits, or via the USAA mobile app, or in a USAA banking location, or at any other location that supports USAA deposits.

Please do not hesitate to contact USAA customer support if you have any concerns about how to deposit money with USAA.

At What Time Will the Money I Deposit Be Ready For Withdrawal?

Your money will normally be ready for withdrawal after one working day, if you deposit at an ATM.

The teller will typically provide you with a receipt when you deposit money at a branch, stating when the money will be ready.

Whatever the case, it’s critical to keep in mind that withdrawal is affected by weekends and holidays.

Where Can I Go to Deposit Money?

With USAA, depositing money is a fast and simple process. Simply sign in to your account, click the “Deposit” button, and then tap “Deposit Checks and Cash.”

Following that, you can input how much money you want to deposit. After you’re done, simply click “Submit,” and you’re good to go!

Prior to depositing money, you ought to be aware of this two factors:

- It usually requires one working day for the money you deposit to show up in your account.

- Remember that you may need exclusive permission from the Legal Department to execute any withdrawal that is greater than $5,000 or 2% of your overall deposits at any specific moment within a calendar month.

Can ATMs Outside My Bank’s Network Permit Deposits?

Money deposits are made simple by ATMs, however what happens if the ATM is not owned by your bank?

The majority of the time, you will not be permitted to deposit funds to an ATM connected to another bank, but you can withdraw it with a cost (except you have an account with that bank).

Conclusion

Thank you for reading this article on “how to deposit cash with USAA?”

USAA offers a large variety of banking services like credit cards, vehicle loans, mortgages etc.

As of today, USAA has above 8.2 million members. USAA financial services is exclusively available to active military officials and their families.

If you are a U.S. military official, you can become a member of USAA along with your family.

In this article, we have already listed four primary methods you can employ in order to deposit cash with USAA. Kindly ensure you understand and apply them.