The Difference Between Personal Taxes and Business Taxes

When you think of making tax returns to the IRS there are many commonalities between personal and business taxes that pop into your mind. However, weighing personal as well as business taxes, in the same way, will reveal how distinct both concepts are.

We at 1800 Accountant are experts in ensuring that your business and personal taxes conform to the tax regulations. Let’s examine what makes the two distinct processes of filing tax returns for personal income as well as the multitude of responsibilities involved in making business income tax filings.

1. There are many unique business tax returns that you can choose from

While Form 1040 is the most common tax return used by most filers for personal tax reasons, however, being an owner of a company gives you access to an array of brand new and distinctive taxes for business profits. It is essential to choose the right tax returns to file to report accurately your business earnings for Uncle Sam.

Sole proprietors declare their self-employment earnings straight on Form 1040 like those who have passed-through structures for businesses. C-corporations owners submit Form 1120. S corporate owners have to submit Form 1120S. Partnerships must file an information return, also known as Form 1065. nonprofits are required to do similar things by filing Form 990. Don’t forget to include estimates of tax payments by filing Form 1040-ES.

This list may also contain tax forms for filing payroll taxes as well as sales and use tax as well as a range of different tax filings based on the location you conduct business.

2. Taxes for business come with additional deadlines for filing

Along with the many tax forms available The responsibility of handling taxes for a business is also accompanied by additional deadlines for filing. People are used to the practice to file taxes on Tax Day, which falls on the 15th of April. If you run a company There are due dates on the calendar all through the year.

For instance, the owners of businesses are required to make estimated tax payments each period on the 15th of January March 15, April 15 June 15, and the 15th of September. Some companies have to pay monthly tax returns for payroll. Furthermore, some businesses’ tax return deadlines are in March, April, and May.

Of course, they can be different based on tax extensions. Therefore, it’s important to keep a detailed calendar and keep track of each deadline for filing throughout the year in order to prevent late filing or penalties.

3. There are more tax deductions for businesses than personal. deductions than personal write-offs.

Tax deductions are a fundamental aspect of being a business owner. If you own hair salons out of an office building downtown or run a tiny vehicle fleet, you’re qualified for a lot greater tax write-offs for an owner of a business that are offered to private individuals.

If you are a taxpayer You may be eligible to deduct employee expenses that are not reimbursed that you incur on your W-2 position. The deduction of mortgage interest and student loan interest might be another option. However, the list of deductions for personal use doesn’t go much deeper than the first.

If you’re a business owner, you’re spending plenty of money on everyday and essential expenses to keep your business up and running. The more you spend, the more you can write off. If you work in an unoccupied bedroom within your home, you might be eligible to claim the deduction for the home office. If you make use of your personal vehicle to make travel between workplaces and work, the deduction for vehicles could be a possibility.

Start-up costs between $5,000 and $5,000 for getting your business moving are also tax-deductible and are deductible along with 50% of food and entertainment expenses and the majority of out-of-pocket medical expenses that you pay for. Of course, nearly any business expenses you incur within your specific field are generally deductible–everything from computers to paper clips to printer paper.

The best way to claim business deductions is by recording every single expense. Keep receipts in a file and arrange them to make it easy to access them at a later date. The IRS frequently asks business owners to submit additional documents to prove that they are indeed eligible to write off the tax they claim on their tax returns.

4. Tax rates for business and personal tax are different

Don’t believe that all personal or taxes for businesses are equal. If you’re a sole proprietor you’ll likely be subject to personal tax rates for your self-employment income. These rates can range between 10 and 39.6 percent. Keep in mind that this amount doesn’t include the 15.3 percent tax on self-employment.

If you’ve formally registered a company and you are a corporate entity, you could be subject to special corporate income tax rates for the income you earn. Corporate tax rates are different from the personal rates of tax. The more income your business earns, the higher your tax bracket you will have to pay as you pay Uncle Sam his fair part.

The tax rates currently for federal companies range from 15 and 39 percent. Remember that several municipalities and states have corporate income tax too, so what you pay in corporate taxes for the federal government isn’t necessarily the case for the total tax on your corporate income responsibility.

Make sure you know how your business’s specific is taxed, so you’re aware of the amount of the earnings you earn will stay in your business bank account, and also how you’ll be liable.

5. When it comes to business taxes It’s all yours

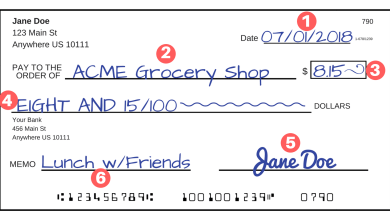

If you’re an employee of W-2 There’s a high chance that you’ll receive an actual paper check or paycheck that’s directly deposited into your account on a weekly basis.

If you took a look at your pay stub, you’ll find that various taxes are deducted from the payment. This is due to the fact that the employer has to deduct Social Security and Medicare taxes along with unemployment tax and any other taxes that are relevant. In the end, you don’t have to do anything else than file a personal tax return in which you list your annual earnings.

But, being a self-employed person is an entirely different game. You are the person who is required to pay all tax-related payments that employers typically make to tax authorities across the year. For instance, you have to pay your Social Security and Medicare tax payments that your employer is likely to withhold from your salary in the role of an employee.

It’s crucial to stay on top of each tax you have to pay to a state, local, or federal tax authority. It’s very easy to forget a tax filing or tax payment due to the high variety of tax obligations for business owners.

In conclusion

It doesn’t matter if you’re an individual filing an uncomplicated return or run multiple businesses which require multiple filings, it’s an excellent idea to collaborate with an accountant to ensure that you’re on the right track and to save you more of your hard-earned cash.

The last thing you’d want to do to do is receive IRS penalty notices each time you check your mailer, just because you weren’t aware of the filing requirements for taxpayers.