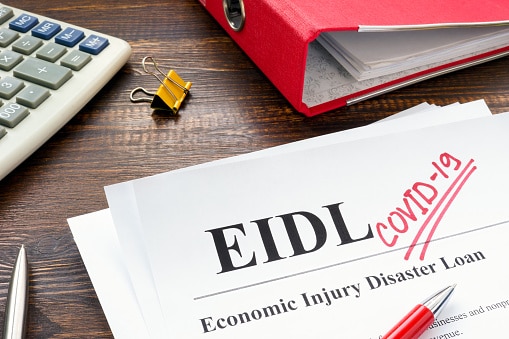

What Can EIDL Loan Be Used For?

What can EIDL loan be used for? This article is a full guide on how to use your EIDL loan in an appropriate way. This article explains how you can and cannot use your EIDL funds.

The Covid-19 pandemic EIDL loan of the SBA is now formally over. The SBA will still review reassessments and raises for applications that were received by December 31, 2021, despite the fact that it is no longer taking new applications.

The EIDL funds is a great option for companies who require funds badly because of its cheap interest rate funding, 24-month postponement time, and lengthy payback periods.

ALSO READ:

How to use EIDL loan for self-employed?

Can you apply for EIDL loan twice?

What Can EIDL Loan Be Used For?

EIDL loan can serve a variety of purposes, however the use of EIDL loans are limited to some extent. What this implies is that there are certain things you are not legally permitted to use EIDL loans for. Here’s a list of things EIDL loans can be used for:

Boost Your Marketing Activities

For most companies, marketing is a necessary investment. Boosting your marketing efforts at these periods will help you build company visibility, put your company in the face of your potential clients and draw additional clients to your company.

Think about splitting your marketing campaign among a variety of advertising platforms, including media platforms, search engines, YouTube, email, and other digital marketing techniques.

Settle Any Other Non-Federal Business Debt

Companies are permitted to use EIDL loans to settle other debt that has to do with business in accordance with the EIDL regulations.

Any other business loan will probably have greater interest rates because the EIDL interest rate is 3.75%.

Your firm may be able to cut costs by using your EIDL loan to settle other business debt, particularly high-interest credit cards.

Additionally, your overall debt load can be significantly reduced by combining your debt into a single low-interest payment by using EIDL loan to settle other debt.

Keep in mind that only expenditures that were authorized by the EIDL may be made with EIDL loans in order to settle other debt.

That is to say, you are not permitted to utilize your EIDL loan to settle debts you presently have if they were incurred for purposes not authorized by EIDL loan, like company growth.

Reserve Funds for Your Rent, Mortgage, and Utility Bills

Another important thing you can do with your EIDL loan is to use some part of the funds for your rent, mortgage, and utility bills. This is undoubtedly a very good means to utilize your EIDL loan.

You Can EIDL Loans to Pay Yourself and Your Staffs

It’s quite important to pay yourself. Payroll can be done with EIDL loan, however you are not permitted to use them to pay owners directly, give incentives, or distribute dividends to investors.

Paying yourself and your staff is not just appropriate, but also required to maintain the operations of your firm.

Invest Some of Your Wage

To be clear, you are not permitted to utilize EIDL loan for rewards or incentives; nevertheless, you may use them for payroll, which covers your wage. It’s essential to make investments and save money with your wage for tomorrow.

You can avoid squandering all of your money in one terrible accident by broadening your financial portfolio, which may also increase your investment yields. Always ensure you get counsel from a specialist prior to making investment decisions.

Make Improvements to Your Company

This is the ideal moment to finish that project that has been sitting unfinished for several months or even years.

Keep in mind that companies are not permitted to use EIDL loan to grow their operations, therefore, be certain that your project is not an expansion.

If you want to improve your house to ensure security, speak with the SBA office closest to you.

However, EIDL funds can be utilized to restore your house if certain parts of your house require serious maintenance or repair.

Increase Your Inventory

From the moment the pandemic struck, supply networks have experienced delays. Certain aspects of the issue don’t appear to be getting better very quickly, and they might likely persist even in few years to come.

Expand your conventional orders if you have the opportunity to do so. This will provide your company with a safety net in case your suppliers experience further setbacks or constraints.

A sufficient inventory can assist to guarantee that your company has the resources it requires to continue generating revenue.

ALSO READ:

What are the new rules for PPP loan forgiveness?

How often does an underwriter deny a loan?

What Can’t EIDL Loan Be Used For?

Although EIDL loan is one of the best relief programs, there are a few significant limitations to be aware of. Below are some of the things you are legally not permitted to use EIDL loan for:

- Relocation

- Incentives and dividends

- Payments made to owners, unless they are substantially connected to the provision of services.

- Maintenance or replacement of physical defects.

Keep in mind that prior limitations prohibited the utilization of EIDL loan for building construction, the purchase of permanent items like cameras or the payback of shareholder loans; however, SBA regulations were revised in September 2021 to permit these uses.

Can I Use My EIDL Loan to Refinance My Debts?

The SBA has modified EIDL loan to allow for the prepayment or payment of business debt. Your EIDL loan can basically be utilized to settle the full remainder of a business loan received via a conventional lender. Additionally, you may settle your federal business debt such as other SBA loans.

Nevertheless, prepayments are not permitted; EIDL loan should solely be utilized for routinely planned payments.

What Can EIDL Advance Be Used For?

The EIDL advance is a grant that was offered to EIDL candidates for a brief while. The grant had a cap of $10,000 and was predicated on $1,000 for each worker.

Because this is a grant, it may be utilized as working income to basically pay for whatever ongoing costs your company may have.

How About If I Have a PPP Loan?

Since the PPP and the EIDL are intended to be utilized in tandem, there are a few restrictions on how to spend the loans if you have both.

Furthermore, during the 8 to 24 week forgiveness term, the EIDL cannot be utilized to cover the exact costs that the PPP covers.

Below are some examples of how you can still make use of your PPP loan:

- Payroll costs

- Making payments for rent

- Utility bills

- The amount of mortgage payments that goes toward interest

So long as you will not be collecting the aforementioned costs under the PPP, you may utilize your EIDL loan to pay for them.

Nevertheless, you may also utilize your EIDL loan to cover the cost of utilities if, for instance, you used the entire PPP loan on rent and payroll.

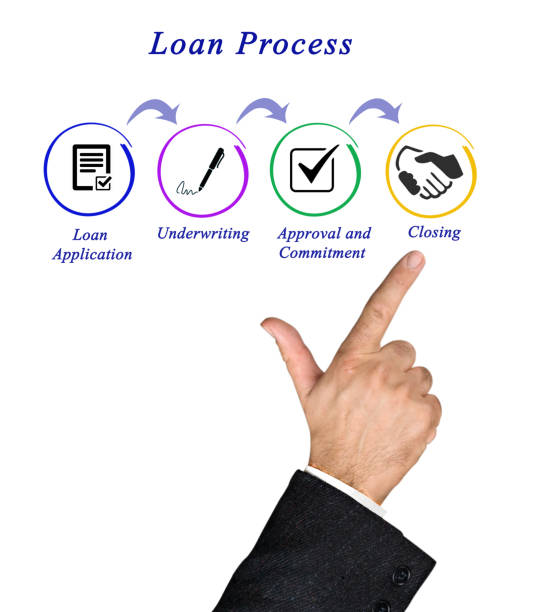

What Is the Safest Method for Monitoring How My EIDL Funds Is Being Used?

The most straightforward approach to monitor of how your EIDL loan are being utilized is to save them in a different bank account.

You may easily give bank statements to the SBA to demonstrate the whole record of transactions involving your EIDL loan if they so request it.

In the end, there is no predetermined rule regarding whatever business account you must withdraw money.

Keep a record of any qualified costs you can connect to the EIDL. If requested by the SBA, you will be required to give account of the business transaction for which you spent EIDL funds while you were in control of the loan.

Conclusion

We have come to the conclusion of this amazing article. EIDL funds can be of great help for businesses that need money seriously due to its minimal interest rate funding, 24 month postponement term and extended repayment term.

In as much as the EIDL funds can be very helpful and easily gotten, do not abuse it. There are some things you are not authorized to use EIDL funds for.

Using EIDL funds for something inappropriate means abusing it, and may attract some penalty. Therefore, ensure to use EIDL funds for only the things it’s meant for.