8 Top Tips You Can Use To Buy A House, Even With Bad Credit

If you’re hoping to end your renting and would like to put down roots for a time, purchasing homes could be the best choice to improve your financial situation and life. But if you’re trying to improve your credit, you might think that buying a house that has bad credit is feasible!

This article will look at the issue. In addition, we’ll discuss the steps to do when purchasing a house with poor credit.

A house purchase with poor credit? Is it even feasible?

If you’re considering buying a house with bad credit, you should know that it’s not simple, but it could be doable for you. It’s just a matter of investing an extra amount of time into making plans and preparations before you can begin seriously searching for homes.

However, it’s an extremely individual experience. The purchase of a house with bad credit may not be on the plans for every person. It’s contingent on a number of elements, including:

- How bad is your credit

- The source of your income, how much, and how stable it is

- Other debts you may have?

- If lenders in your region are willing to collaborate with you

In the next steps, we’ll dive deeper into the various aspects of this and the ways you can leverage your strengths to counter your weaknesses.

8 steps you must take to purchase a home with poor credit

If you’re looking to purchase an apartment with poor credit, following these steps can help you determine where you are and what you should do!

1. Get your credit report

One of the first steps, naturally first, is to determine the place you’re beginning from and the credit score you’re using! Your credit score is comprised of factors like the ratio of credit utilization and your payment history. You can get the most official report from AnnualCreditReport.com, but typically it’s limited to once a year for free.

You will receive a credit report from each of the three principal credit agencies (Equifax, Experian, and TransUnion). They use somewhat different criteria to determine your score. Therefore, you can expect to see a distinct number for every bureau, although they’ll be in the same range.

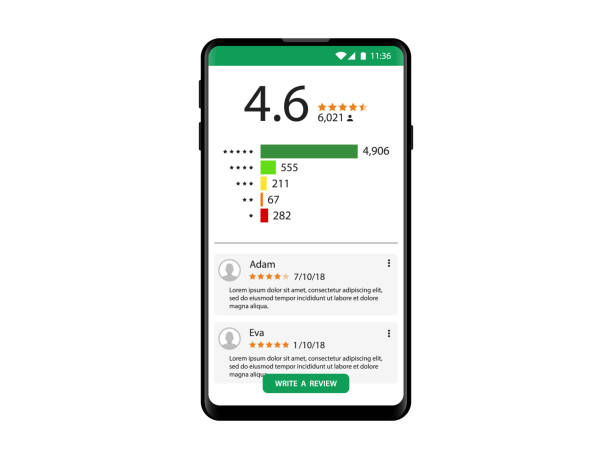

There are also services that are free such as CreditKarma to check your score regularly and keep track of the changes in your score. CreditKarma makes use of scores from both your Equifax as well as TransUnion scores. In order to help you assess your credit health, various ranges of credit scores are separated into the following categories:

- Exceptional: 800-850

- Very good. 740-799

- Good: 670-739

- Fair: 580-669

- Poor: Under 580

If you score within either of these two top rates can get you the top interest rates, whereas you’ll have more difficulty getting approvals in the two lowest ranges. The “good” range is fairly average, and you may not be able to get every offer when you reach 670. However, it will provide you with more choices.

Although it can be difficult to look at a poor credit rating, this is actually one of the essential steps in purchasing a home with poor credit. Find out all you can about credit you can in order to increase your score faster.

A minimum credit score is required when purchasing an investment property with poor credit

What is the minimum score you can be to be able to get mortgage approval as a first-time homeowner with poor credit? The typical minimum credit score needed to buy a home is 500-620, dependent on the type of loan. FHA loans can allow fewer credit scores, but they are typically in the 500-620 to 620 range.

2. Be prepared to pay more mortgage interest

A credit score that is low indicates an increased risk for lenders. To offset that potential risk, any loan offers they make are usually with a higher rate of interest (e.g. an annual 5% cost instead of the 3% for a high score).

The differences of a single digit may sound tiny, but they really add to a lot when you consider the mortgage term is 15-30 years. It is possible to have a greater monthly mortgage payment. This article provides an example that shows how credit scores could influence your mortgage rate and the amount you may have to pay in the future.

If you’re wondering how to purchase a house with poor credit but still be forced to pay a large amount for the rest of your life There’s a good thing. It’s true that even if you’re beginning with a high-interest rate on your mortgage, that does not mean that you’re bound to this rate for the rest of your all-time. It’s possible to refinance your mortgage to get lower rates later on when your credit score improves.

3. Repay your other debt

Another factor that is more crucial in the eyes of mortgage brokers than credit scores is the “debt-to-income,” or DTI ratio. The term “debt-to-income” is extremely descriptive. It is simply a comparison of the total amount of debt you pay each month to your monthly income.

It lets lenders determine the number of other debts you’ve got. In addition, it tells you how much of your earnings you could allocate for the remainder of your monthly expenses.

To determine your personal debt total monthly debt repayments (credit card bills as well as student loans, car loans, and the upcoming mortgage payment you’re contemplating). Divide it by your average monthly income. Lenders prefer DTI ratios below 36%.

If you’re currently burdened by an enormous monthly burden of other debts, you should plan to address them prior to when you consider buying a home. Repaying your other debt appears attractive to potential lenders. This will increase your credit score and reduce your DTI number.

If you follow these, you might not be purchasing a house with bad credit as your score may increase. Take a look at our article on six steps to pay off debt!

4. Determine your budget

Before you begin to look for homes and get your eyes set on a dream house that isn’t within your budget, sit down and figure out what you can be able to afford. This is among the crucial steps for purchasing a house even if you have bad credit.

It is not a good idea to buy more property than you really require and then end up “house poor”. That is, spending a large portion of your income on a home or mortgage and not having enough to save, invest or use for other expenditures.

Because you’ll likely be paying more for interest when purchasing a home with poor credit, there’s an additional reason to purchase a house that is less than your budget.

A good guideline is to not spend more than 28 percent of your gross income on mortgages. E.g. If you earn $50,000 a year then you’ll need to search for a home and a mortgage that will cost you an average of $14,000 per year, or roughly $1150/month.

Although you aren’t required to include additional home-related costs in the 28% you should consider these. If you’re considering buying a fixer-upper due to its low cost, you should research what the needed changes will cost. So, you won’t be taken by surprise.

5. Set aside money to pay for a down payment

If you’re purchasing a home with poor credit, putting aside an adequate down payment could help you qualify for various loans. Making a large chunk of the purchase cost means you’ll be able to get a lower loan. You can still make an enormous down payment in the case of buying a house with poor credit.

Additionally, every dollar you put aside to pay for a down payment is money that won’t be paying the interest you pay on your mortgage. Making a down payment that is 20% of the house’s cost is a great choice for two reasons.

LTV = Loan-to-Value (LTV) ratio

This number is a comparison of the amount you owe against the value of your home.

If you’re looking to purchase a $150,000 house and you put down 20 percent ($30,000) then your mortgage loan amount would be $120,000. Compare the loan amount to the home’s value–$120,000/$150,000–and you get an LTV ratio of 80%.

If you put down only 10 percent ($15,000) then the LTV ratio will be 90 90%. Loan lenders aren’t keen on large LTV ratios because you’re more likely to be in default on your loan if do not have a lot of equity in your home. This means they could have higher rates of interest if your LTV exceeds 80 percent.

PMI (Private Mortgage Insurance)

If your LTV is greater than 80 percent, you’ll likely have the PMI (private mortgage insurance). PMI safeguards lenders in the event that the borrower fails to pay their loan. Since they view you as having a greater risk with a lower amount of downpayment, they pay PMI in exchange for them providing you with insurance.

This isn’t a requirement to make 20% of your own amount. If you’re paying an enormous amount in rent per month, it may be more affordable to purchase a house. Even with higher rates of interest and PMI, so long as you’re approved, naturally.

The moral is that if you are able to afford at least 20 is a good option to take even when you’re purchasing a home with poor credit. It may take some time however don’t get discouraged. Utilize these strategies to save money for a down payment. Be perseverant; you’ll be there!

If your bank account is at the amount you want to pay down Keep saving until you have an emergency fund. There should be an emergency savings account. Your emergency fund will help prepare you for unexpected costs and other life events.

6. Utilize leverage to get an FHA loan

Federal Housing Administration (FHA) loans are intended to bring homeowners in the position who might be unable to obtain a traditional loan. They are particularly suitable for those who are new to the market as they typically require lower down amounts than private lenders could.

You’ll require a credit score of a minimum 580 to be eligible in the event of an FHA loan that has the requirement of a 3.5 percent minimum down payment. When your credit rating falls between 500 and 579, then you’ll require a 10 percent downpayment in order to be eligible for the FHA loan. Therefore, buying a house with a bad credit score is feasible.

The whole thing sounds fantastic, but there are some disadvantages to obtaining the FHA loan. We’ve discussed PMI in the past, and though it’s a different type when compared to a federal loan it’s similar to a federal loan. In reality, you’ll pay two kinds of premiums for mortgage insurance (MIP):

Upfront MIP (Mortgage Insurance Premiums)

This is a one-time installment equivalent to 1.75 percent of your base amount. The payment can be made upfront in the closing process or added to the loan. If you’re in a cash crunch and need to pay for your loan, you may be able to take this second choice, giving you the flexibility to make payments.

Annual MIP (Mortgage Insurance Premiums)

These are regular payments that range between 0.45 percent to 1.05 percent of the loan’s base amount each year. Annual MIPs are split into 12 installments per year. You’ll have to pay the amount for 11 years, or until the end of your loan. As the loan balance decreases lower the annual MIP reduces, since it’s calculated as a percentage.

For example, take our house for $150,000. Let’s say you have put down $15,000, which means your FHA loan is $135,000. The initial MIP for you is $2360. Your first-year MIP for the year could range between $600 and $1350.

The more costly the home and the smaller you’ll have to pay for your mortgage, the more MIPs of both kinds will be.

In addition to the additional insurance costs, in addition, there are additional prerequisites to be met for FHA loans. It is necessary to have an ongoing job (or self-employment) record for a minimum of two years. Additionally, you must choose a lender that is FHA-approved and purchase a home priced under a specific limit determined by the cost of living in the location.

7. Check if you are eligible to receive a VA loan or USDA loan

If you’re a veteran, or you’re a homebuyer with a lower income located in a rural area that is USDA-eligible You’ll also have two different kinds of credit-flexible loans available to you.

VA housing loans

A VA loan is offered to veterans, service members, and spouses of survivors. Benefits include low-interest rates, government backing, and no or low down-payment requirements.

The requirements for credit scores differ by the lender. However, they have to look at the complete credit profile, instead of denial just on the basis of credit. This can assist you to purchase an apartment with poor credit.

USDA loan program

The United States Department of Agriculture provides mortgage assistance to those with a low to moderate income in rural areas with a qualifying area. There’s no PMI, down payment, or credit score requirements–lenders look at other parts of your financial history.

8. Enhance your credit score by buying a house with poor credit

The final step for buying a house where you have bad credit is to improve your credit score. As previously mentioned the credit score is a major factor in the interest rate you receive. When you take out mortgages, the amount of interest you pay can be anywhere from tens of thousands to thousand of dollars.

It’s, therefore, an ideal idea to focus on getting your credit score as good as possible before you make a decision to buy a home. If you see homeownership as a possibility coming in the near future, you should start making steps to improve your credit as soon as you are able. So you don’t have to be concerned about purchasing the house you want with a poor credit score.

It is important to give the process enough time so that you’ll be able to see the results. So, you’ll be on the way to the most favorable interest rate in light of your credit score.

3 ways to buy an apartment without credit

We’ve talked about how to purchase an apartment with poor credit. However, there’s a different scenario to consider. If you don’t have any credit history, purchasing homes is a different procedure.

It’s not like buying a house with poor credit. Here are some guidelines to consider.

1. Manual underwriting

Every lender wants to be sure that you’ll pay back the amount you borrowed and be able to pay the monthly mortgage payments. However, if you don’t have any credit rating, you’ll need proof you are able to pay for your home with various methods.

Manual underwriting could aid you in getting a loan when you’re looking to purchase a house without credit. This is a procedure that requires looking over the bank’s statements, insurance details as well as other financial information before deciding if you want to take out a loan.

2. Find a co-signer

If you are buying a home without credit, a cosigner may be an option. If you have an additional co-signer, they will be accountable for the mortgage in the event that you are unable to pay it.

It’s a major decision and it’s possible that it will not be the best option for your particular situation. Being a co-signer does not mean you are also the owner of the property, you simply assist in making the payments.

3. Make sure to save money and be prepared

You’ll need to put aside an initial down payment to make the purchase. Generally speaking, taking 20% of the purchase price is a great option, as you won’t be required for PMI.

It’s crucial to save without credit as you have to be prepared to pay for future expenses without credit cards.

It is also important to be aware of your monthly net and gross income, as well as the expected expenses for your house, which include more than the loan for the home. Find out everything you require to know to be financially prepared to make this transition before purchasing an uncreditworthy home.

If you follow the right steps, purchasing a home that has bad credit can be accomplished!

If you follow these strategies, buying a house even with bad credit is feasible. Even if you’re unable to purchase a house immediately, set it as an objective to work towards and you’ll eventually get there. Learn more about our free course to get ideas on building credit.

It’s all about making sure you’re on the right way to achieving your home ownership dreams!