What Does A Six-Figure Salary Get You, and Means?

A salary of six figures can appear like a dream that comes to life. After all the efforts, you’re paid zeros on your pay. But, one important thing to remember is that the zeros you earn don’t necessarily translate to a luxurious life.

An annual salary of six figures is the height of their earnings potential. But, many people never achieve that level of income. What exactly is a six-figure salary, and how can an income of that kind really do to help you reach your goals?

Let’s take a look at what a six-figure income actually means to you and your financial health.

What’re 6 figures? money?

What do you mean by 6 figures in cash to you? Any amount that is greater than $100,000, but not less than a million is considered to be 6 figures in cash.

Then, based on that, what exactly is a six-figure salary? In essence, any profession which earns more than $100,000 per year, but not more than one million dollars is thought to be an income of six figures. As you can see, the amount of money is quite large when it comes to the definition of what a six-figure income is.

What kinds of jobs pay six figures?

Once you’ve learned the significance of the six-figure salary you might be thinking about what you can do to earn it. If you’re one who aspirations of becoming a top-earning person, then you’ll need to locate an exciting career pathway.

There are many lucrative jobs in the six figures available. Of course, lawyers and doctors immediately spring to mind as top earners. Doctors have median earnings of $208,000 while lawyers make a median salary of $120,910. Both earn six-figure salaries however, doctors earn significantly higher median salaries.

Other lucrative career options include:

- Bankers in the field of investment

- Air traffic controllers

- Commercial pilots

- Pharmacists

- Marketing managers

- Human resource managers

- Actuaries

CEOs: Chief Executive Officers (Such as Oprah Winfrey, founder of Harpo Productions, and Huda Kattan, the CEO of Huda Cosmetics)

Professionals can earn more than six figures per year. However, traditional paths aren’t the only choice. With the aid of the internet, entrepreneurs have the ability to make huge earnings without having to go through rigorous schooling. Keep in mind that you don’t need to select only career paths that pay high wages.

What is a six-figure income?

Even if you don’t earn a six-figure income at your job 9-5 doesn’t mean that you aren’t earning more than six figures! What exactly is a six-figure salary and how does it differ from a job that pays a six-figure salary?

The main distinction between “income” and “job” is the point at which extra income streams and side hustles are involved. It is possible to earn over six figures by boosting your income stream via these channels.

In fact, many are learning to become freelance YouTubers, writers, bloggers virtual assistants, and hustle their way up the ladder, all at the ease at home. Some lifestyle influencers even make 6 figure salaries!

You never thought that you could be an entrepreneur with a six-figure salary in the comfort of your home! This shows that huge earnings can be earned by anyone other than professional athletes and actors!

Others earn a good living by earning passive incomes as well. If you diversify your income streams, you could earn over 6 figures per year.

The best part is that you don’t have to earn an education degree in order to earn six-figure earnings!

A life that is enriched by earning six figures

Many dreams of the status of a six-figure income. The typical dream life includes expensive cars, luxurious holidays, and huge houses. However, a lavish lifestyle that includes expensive items can eat up your earnings fast.

The excitement surrounding earning six figures is the sensation that you’ve achieved it. A large salary can make you feel as if you’ve made your dream of the American Dream a reality. However, that’s not always the case.

If you are spending your whole salary living a lavish life that is filled with glittering things, you’ll find yourself in a downward cycle. While your earnings will be higher, however, you can become swept up in living pay check to paycheck.

The issue is due to the fact that people are confused by the word “income” with “wealth. Income is money that is paid to your bank account every payday. Wealth is the money you’ve saved and grown over time.

Wealth is available for you to utilize regardless of whether you earn an income. Your income can be used to increase your wealth however, you should not depend on income as a way to replenish wealth.

What’s the 6-figure salary? Six factors that impact your salary

Even if you do make it to the six-figure milestone in your salary There are many variables that will impact the value of your pay. There could be obligations that are beyond your control, which take an enormous chunk of your earnings.

This means that your salary isn’t what you believe! So, what does a six-figure salary really worth when these variables are considered?

Let’s examine how your income could be diminished.

1. The credit card balance

A salary of 6 figures can be plenty if you’re overwhelmed by the debt of your credit cards. The high-interest debts can quickly consume your income, leaving you with any money left at the close of every month.

It does not matter how much money you earn if you are living beyond your means, you’ll always live in a pay check to pay check cycle.

2. Student loan debt

Student loans are a permanent issue for Americans. If you’ve taken out large amounts of student loans to pay for your education, you’re liable for a huge cost. In some instances, you might have required an expensive degree to be able to secure an excellent job.

Consider doctors as an example. students from medical faculties owe $241,600 in Student loan loans!

After you’ve found a well-paying job, your student loan debt doesn’t disappear. It instead eats away your earnings while you earn a steady income. If you do not have a plan to pay off the debt from student loans and pay it off, it could be a drain on your earnings for a long time.

3. The place you reside

Living expenses can vary greatly across the United States. In general, cities with larger populations come with higher costs of living. San Francisco, New York City as well as Washington D.C. are just some examples of a cost of living. If you reside in a costly living region, then your earnings may not go far.

For instance, the typical price of a one-bedroom residence located in New York City is $3,225 each month. If you’re spending more than $38,700 annually on the basic rent of your home, the other expenses can be quite high. It is important to think about the cost of utilities, transportation, and food expenses can quickly add up in large cities.

However, Orlando, FL. provides a more affordable price of life. The cost of one-bedroom apartments within Orlando can be found at $1,597. If you’re spending less than $20k to rent an apartment, you’ll be able to extend your money even further.

This is also true for buying the home of your dreams. It isn’t a good idea to extend yourself enough that you’ll become “house poor” from your high mortgage costs!

Be aware of this when you seek a six-figure job. An income that is high in a lower cost of living area could be more profitable than a large salary in a city that is expensive.

4. Happiness

The saying goes that money can bring you joy, but is this real? Let’s suppose you have an income of $100,000, but it leaves you miserable. What will that salary do to your satisfaction if you’re miserable for at most 40 hours a week?

Happiness is not something that can be purchased. Sure, earning more money may aid in easing financial pressure in some ways, but it’s not the case if you work in a place that is making you miserable.

A six-figure salary isn’t required when it comes to the ultimate happiness.

5. Time

If we want to whether we like it or not time can be our most precious resource. We all have the entire day to live the way we want and only a certain amount of days to live. The way we spend our days is vital for our satisfaction.

A lot of people spend between 60 and 80 hours per week in the office to earn a six-figure salary. This time working can take away time from your daily life. You may long for a longer time to spend time with your family or pursue your passion, or take a break and relax.

When you’re running out of time and have a tight schedule, you will spend more money to make up for it. As an example, you may skip cooking meals at home in order to reduce time or avoid exercising since you’re simply running and not having the time. Small choices can lead to an expensive lifestyle, which reduces your income even more.

6. Taxes

Uncle Sam and his family will take a percentage of each penny you earn. Even though your earnings may exceed $100,000, the amount you take home is what you’ve actually made. However, the post-tax number might be more disappointing.

Let’s say that a person’s six-figure salary is $100,000 before tax. Also, let’s assume that they live within New York City and are single. Utilizing a tax calculator for income the take-home salary is $68,000.

This figure is after federal taxes, state, and other taxes. While $68,000 is quite a bit of money, it’s significantly smaller than $100,000!

Based on the state you reside in, you could be subject to different taxes. Find out more about this here to get more information about what taxes will cost you every year.

7. Lifestyle creep

Achieving 6 figures is an amazing method of living. However, it is important to be aware of the effects of lifestyle inflation. This is the time when you start to make more purchases due to the increase in income. Whatever you earn, you need to make sure that you are in the right place to prevent living a life of luxury.

In the event that you do not, you’ll be living from paycheck to paycheck, no matter the amount of money you earn.

Do you require a 6 figure salary to make money?

Many dreams of achieving the dream of earning six figures However, most people do not. Based on the Bureau of Labor Statistics, the median income for all employed Americans older than 16 is $908 per week or $47,216 for the year. The median is slightly higher for those aged 25-34 to $1,022 per week, or $53,144. But both are far from the $100,000.

Does this mean that it’s impossible for the majority of people to have financial security? No! It is completely possible to make wealth on the basis of a smaller amount of income. Wealth creation is more about the money you do with your money than the amount you spend.

As you earn wealth over time your savings will accumulate. But, if you are spending the entire amount of your salary, you won’t build wealth in any way. For instance, let’s say you make $100,000 but you spend the entire amount.

Are you actually more fortunate than someone who earns $50,000, but manages to save $10,000 every year? In the long run, it is not. While you may appreciate the luxury of living a “rich life, they are not going to be able to ensure that retirement is an actual reality.

How do you build wealth without earning a six-figure salary

Wealth creation isn’t easy however it is easy to achieve. While it takes perseverance and determination to accomplish your goals, you can create wealth and boost your net worth. This is what you’ll have to do to create wealth, without having an income of six figures.

1. Find the reason

The process of building wealth is a lengthy project. It won’t take place overnight, and you’ll need to be a dedicated worker to achieve it. There will be times when you have to decide to turn down your immediate desires to be able to finance your goals for the long term.

This could mean eating more at home for meals and avoiding shopping or even opting for an older vehicle. These are all reasonable when it comes to achieving the goal. If you don’t have a target with which to focus, it may be difficult to keep on track.

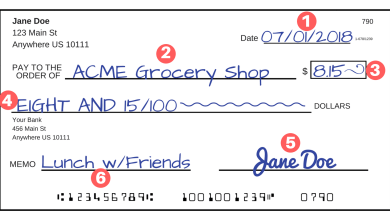

2. Repay the debt

If you’re in any kind of outstanding debt, now is time to take the time to pay the debt off. The ability of debt is enormous and can limit your wealth-building goals. Every penny you pay for your debts each month can be better utilized to invest in a strategy for the accumulation of wealth over time.

Have a look at your debts. Make a list of everything you owe on one page of the paper, and then you can determine exactly how much you are owed both in white and black. It might be shocking to see it on paper but it’s a great method to get you started on your motivation.

The reality is that, if you don’t do anything about it, you will take years to pay off massive high-interest loans. Make a plan and implement the right strategy for repaying your debt now.

3. Evaluate your lifestyle

Take a look at your expenses to figure out if you’re able to live your life comfortably. It is crucial to be completely truthful regarding your expenditure to obtain an accurate view.

Find ways to reduce the cost of your purchases without hurting your joy. You may be amazed by the number of savings opportunities that can be found.

4. Make sure you save your money

The first step to building wealth is conserving your cash. While you could start with the emergency savings account, the process of building wealth can go beyond just a couple of thousand dollars. Consider how you would like your life to be in the near future.

Do you wish to keep working hard all the time? Do you want to accumulate enough money to have an alternative lifestyle? If you’re aiming for high-minded goals, like retiring in the near future and saving cash now is essential.

There may be a feeling that you’ve got enough money to save however, every bit matters. Take the time to save money in small increments. It doesn’t have to be earning a six-figure salary to begin saving money!

5. Put your savings into investing

It’s not enough to save money. You should also invest in it. It is possible for your investment to increase over time. As your investments increase you will be grateful for making the decision to invest.

If you’re not sure where to start considering the best investment strategies for you. It’s crucial to know how to construct a diversified investment portfolio to get your money to work for you!

6. Earn more money

While you can make a fortune regardless of your salary, having more income can boost your progress. The best way to do this is to solicit an increase. Although it might seem scary engaging in an agreement on your salary with your employer may be rewarding. You could be able to get better pay at the same time.

In addition, you’ll develop confidence in yourself when you stand in your own position. If you’ve tried salary negotiations, but came to the wall There are still alternatives. Making a side business is an amazing method to increase your earnings.

A profitable side hustle will boost your earnings. While at the same time you’ll acquire new skills that increase your value as an employee for your employer. When you earn more be sure to channel the money to create wealth.

You can make money without earning a six-figure salary!

A 6-figure income can be beneficial, but it isn’t the most important aspect of wealth-building. What you decide to make of your earnings regardless of their size is the most important. If you spend all your money on your daily costs, then your substantial income will not go far in the end.