Which Problem Would Be Best Addressed By a Business Bank?

Many times, we have received several questions from our reading audience concerning which problem would be best addressed by a business bank.

In this article, we shall reveal to you the problems that would be best addressed by a business bank.

Numerous managers of small firms are still making us of their private accounts rather than business banking services.

As a rookie entrepreneur, you might decide to split up your individual and commercial funds then seek out a local bank that could provide you the most effective business bank accounts.

But first, you ought to be aware of your necessity for that kind of account. Possessing checking accounts for your company at the appropriate business bank could help you with several issues you might often face.

ALSO READ:

How to fund my trust wallet from my bank account

How many jobs are available in commercial banks?

What Is a Business Bank Account?

A business bank account is an account that aids an entrepreneur to distinct commercial deals private income, and frequently has unique features for companies.

The benefits of opening a different bank account for your company is clearly visible. This aids entrepreneurs in keeping track of their expenditures, control working capital and facilitate the determination of tax obligation.

Business bank accounts is not the same with personal or private bank accounts. They are designed primarily for commercial use.

In selecting the ideal business bank account for your business, it is advised that you search for one with reasonable charges and favorable interest percentages.

It essentially relies on what the routine commercial activities entail. As an illustration, if you anticipate mostly using online payment methods, the ideal business bank account would provide free or inexpensive online services.

As opposed to that, if your company predominantly utilizes cheques, you should search around for lesser charges for paper-based payments.

Numerous banks possess excellent assets for startups like consulting committees, hotlines, and further advantages for companies for their customers.

Which Problem Would Be Best Addressed By a Business Bank?

The following problem would be best addressed by a business bank:

Lack of competence

Owing to the absence of a small business bank account, and rather making use your private account, you run the danger of appearing incompetent.

Every time you send or collect money, the individual you are dealing with can quickly detect that the whole transactions were done from one a private account.

This kind of lack of competence can make customers feel more uneasy. Since they didn’t see a business bank account, they will think that you’re merely kind of managing the company, typically as a supplementary business.

As opposed to that, if you make use of a business account for your company, they’ll see you’re serious about doing business.

Lack of competence is one of the problem that would be best addressed by a business bank.

Possessing a business bank account makes you highly competent and professional in the sight of your customers or clients.

Finance Control Challenges

As a rookie entrepreneur, you might encounter challenges keeping your private and commercial expenditures apart.

As an illustration, if you are employed by a tech firm, you would need to manage your finances well and direct it at taxes, instruments, payments and plenty others.

If you solely utilize your private account, you could wind up paying extra than you ought to on private matters, exposing the expenditures of your company. Nevertheless, business checking accounts assist you in preventing that.

Along with connecting directly to a unique business savings account. However they also have a number of tools geared for businesses for handling money.

ALSO READ:

Will insurance cover braces twice?

Private Responsibility

A lot of individuals just utilize their outdated private accounts. So that they are not required to look around with the aid of monetary firms, creating different accounts.

The issue is that whenever you utilize a private account, afterward, you assume personal accountability for the issues that arise in your company.

Small business bank accounts will distinguish between your private and commercial money. Therefore, regardless if you are in debt, it won’t be taken from your private account – largely due to it will be just the business account to draw on.

Credit Card Transactions

The problem with credit card transactions should be properly handled by a business bank account.

Private accounts at a small bank within the financial sector probably won’t be much of an assistance to you, as neither credit cards nor a credit line are available from them.

Having stated that, banks’ first lines of defense to companies will probably offer you the choice to pay with a credit card.

Credit card use is popular among customers. Hence, if they notice that a company cannot be paid with a credit card, they’ll merely shift their focus elsewhere.

Business bank accounts will address these problems. Regardless if you use simple checking account services, you ought to enable credit card transactions if your small firm is officially licensed.

ALSO READ:

Low Credit Score

If your credit score is low for your company, therefore a private account won’t be any use to you. A small-town bank, as opposed to that, will probably offer you credit alternatives, for example, a line of credit with corresponding credit cards.

Anytime you utilize those credit cards, and promptly repay your loan, your interaction with the bank will be strengthened.

You’ll demonstrate to them that you can pay your bills on time and ensure that you won’t let your loan go behind.

This may result in a lower interest rate for you if you’re trying to get a commercial loan.

No financing for the company

Occasionally, small firms may require capital. Nevertheless, if you don’t have a business account you might only be able to apply for a private loan.

It’s possible that this might not be sufficient to pay for all of your expenditures.

As opposed to that, if small companies had to make a decision of the optimum business bank account, they will have access to startup funding.

Additionally, this will assist you not merely with cash, however this would definitely aid in improving your friendship with the bank.

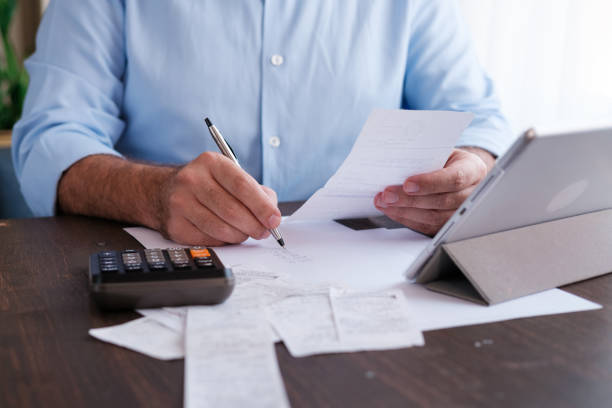

Paying Taxes

A business account will possess budgeting apps that can be useful while filing taxes. If you utilize a private account, your private funds will interfere with the funds of your company.

During tax season, this may lead to a lot of uncertainty. A tax processor can help you segregate your expenditures, however, they might not be sure of the dealings that were commercial and the ones that were private.

As a result, you risk omitting important reductions. The easiest way to solve this issue is through opening a different business bank account.

Your transactions won’t be jumbled up anymore and no reductions will be overlooked. For example, if you open a Bonsai Cash account, you will be permitted to use their tax preparation software.

By doing so, you won’t get in trouble for attempting to take a reduction that is improper. Additionally, your financial adviser will be pleased, as you’d be making their work simpler.

Business Union or Affiliation

When you integrate your company or establish a corporate alliance, a person must oversee financial dealings for your company.

Something like this cannot be carried out with a private account, as there may be significant issues which you must attend to.

As opposed to that, small business checking accounts should have the capacity to rectify this issue. By doing so, your company will be treated as a distinct formal organization, and you’ll have no trouble integrating it.

ALSO READ:

Types of Business Bank Accounts

There are typically two types of business bank accounts:

Transaction Type

Your income usually originates from here. As an illustration, when you bill a client, you give them the account details for your client to make payments.

Additionally, a transaction account is where commercial expenditures are deducted. As an illustration, when you pay employees, purchase commodities or resources, or perhaps cover the expense of maintenance – Your business transaction account is where money is taken out.

As a result, you can typically couple a transaction account with business credit or debit cards. By so doing, business owner can easily cover commercial-related expenditures.

Savings Account

This is the second type of business account. In contrast to a regular transaction account, a business savings account has a set or adjustable interest rate most of the time.

A business savings account’s underlying idea is so you will be able to reserve extra money circulation and collect interest.

Majority of entrepreneurs choose a business bank account from the onset and ever think about changing.

While this might be beneficial, you might be skipping out on key aspects and advantages if you were to compare rates.

As an illustration, switching to a different bank for the banking of your company could enable you to have additional integrations of POS and card processing that is inexpensive.

Why You Should Open a Business Bank Account for Your Company

Generally speaking, nearly every bank provides a business account, however, there could be certain banks that will not.

As the manager of a startup, you must seek out for the appropriate financial institutions that presents suitable funding potentials to firms.

A business bank should offer specialized services that precisely meet a company’s requirements, enabling improved income flow control.

Below are 6 reasons you should open a business account for your company

- Simplify Tax Processing

- Optimize Your Accounting

- Defend yourself against the risk of financial bankruptcy

- Create Company Credit

- Facilitate Loan or Government Support Application Process

- Appear Very Competent

Conclusion

Finally, we strongly believe that this article on “which problem would be best addressed by a business bank” has given you insights on problems that would be best addressed by business banks.

In order to look professional there is a necessity for you to open a business bank account for your business and company.

As a small business owner, you must look for the right financial institution that offers appropriate investment opportunities to businesses.