Does Afterpay Report to Credit Bureaus?

Does Afterpay report to credit bureaus? This article explains everything about Afterpay and how they work, as well as if they report to credit bureaus.

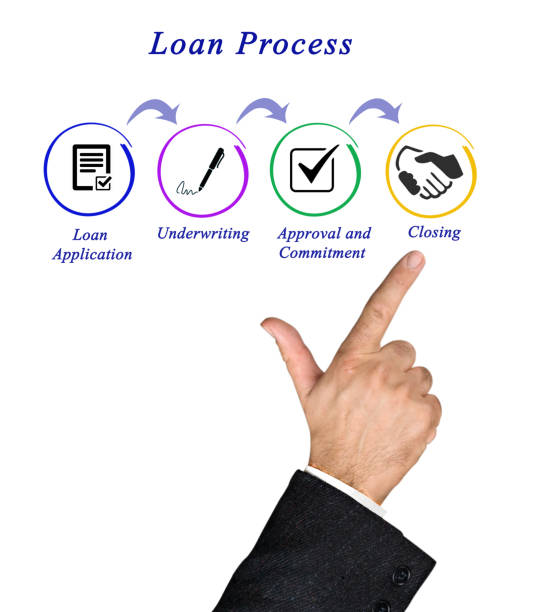

“Buy-now-pay-later” loans allows you to make a significant purchase at no interest. Nevertheless, many BNPL services have the potential to harm your credit score.

Also called a point-of-sale loan, a BNPL gives you the option to make installment payments over a certain duration of time in order to buy goods.

The regular deadlines for the payments are either biweekly or monthly. The loans are usually just temporary and are repaid in three to four months. Affirm, Klarna, and Afterpay are the top three main kinds of BNPL lenders.

ALSO READ:

How much does a cosigner help on auto loans?

What is Afterpay?

Afterpay is a popular Australian fintech business popularly known for offering buy now, pay later (BNPL) programs.

Australia, the UK, Canada, the US, and New Zealand are among the countries where it is active. Anthony Eisen and Nick Molnar established Afterpay in 2014.

The Afterpay Touch Group was created in June 2017 following the amalgamation of Afterpay and Touchcorp, one of its tech partners.

The firm changed its name to Afterpay Limited in November 2019. Afterpay and American payments firm Square, Inc. declared in August 2021 that they had signed a contract for Square to buy Afterpay for US$29 billion (A$39 billion), a deal that was eventually finalized on January 31, 2022.

Can Afterpay Affect My Credit Score or Credit Rating?

No, Afterpay doesn’t affect your credit score or credit rating. You are fortunate when it has to do with your credit if you chose to try Afterpay BNPL program.

Afterpay doesn’t report payments to credit bureaus, which has the potential to hurt your credit score.

You can lend funds through Afterpay without having a credit check performed on you. That’s beneficial for your credit score because it normally suffers when creditors review it before giving you a loan.

Afterpay doesn’t stop individuals from using their service probably due to the fact that they may have an unpaid debt in the past.

Additionally, Afterpay doesn’t think that failing to make an Afterpay payment should harm one’s credit score.

The firm will adopt additional measures, such as stopping your account or imposing late charges, if you fail to make a payment.

Afterpay’s primary goal is to constantly assist you in making smart purchases, and they employ numerous measures to in order to accomplish this.

How Does Afterpay Function?

Afterpay serves as a middleman service between sellers and clients. Afterpay purchases the items from the seller in advance and is subsequently reimbursed by the client.

Although your purchases could provide quick pleasure, you will have to make four biweekly payments within the course of two months.

These payments are without interest and of same amount for all orders. Despite not charging interest, Afterpay does impose charges to retailers who use the service as well as late penalties to users who miss payments.

There are less protections for clients because Afterpay does not compel users to sign up for a loan or credit arrangement.

Clients are not compelled to sign up for a loan or credit arrangement using Afterpay, in contrast to numerous other payment alternatives.

Although the client may interpret this as a benefit, it really implies that less protections are in effect for clients.

One out of every six participants in BNPL programs, according to an ASIC investigation, experienced having trouble making payments.

The sudden thrill of acquiring your things immediately combined with the lure of those relatively little installments can become overwhelming.

ALSO READ:

Will Geico insure a car not in my name?

How to use EIDL loan for self-employed?

How Does Afterpay Generate Revenue?

43,000 registered retailers generate the lion’s share of Afterpay’s income. According to sources, Afterpay bills them a set service cost of $0.30 and a commission of around 3% and 7% on every sale, which is significantly more than what banks bill them to handle other payment forms.

Merchants believe that greater sales will offset the costs they pay. Afterpay earned revenue from merchants totaling over $179.6 million as at late December 2019, plus an extra $32.6 million in late charges, or about 18.7% of their income, a decrease from 24.4% in 2018.

Clients who failed to pay their bills resulted in reversal and debt collection expenses of $6.5 million.

Does Afterpay Perform a Credit Check?

No, Afterpay lack the authority to perform a credit check or report data to credit bureaus. There will be no impact on your credit history if there is no background check.

Nevertheless, credit checks serve as a kind of consumer protection by prohibiting lenders from encouraging dangerous amounts of debt.

Take note that Afterpay varies from other kinds of credit because there isn’t a preliminary credit check.

You are expected to ensure you are able afford Afterpay since there isn’t a thorough analysis done to see if it meets your demands or your financial situation.

It would be better if all BNPL programs perform credit checks. These aid in guaranteeing that financial institutions do no damage.

BNPL program should conduct simple financial checks instead of expecting clients to assume all risk because they are knowledgeable about their product and the information.

How Can I Make Use of Afterpay?

Create an Account

You must first create an account on Afterpay’s website or app before you can utilize it. You must be at least 18 years old, have a legitimate Visa or Mastercard debit or credit card in your name, and be eligible to sign an agreement with legal consequences.

In order to avoid the establishment of numerous accounts, you must register with a legitimate email address, phone number, and ID.

When the merchant gives the Afterpay alternative at checkout, you can begin utilizing it by logging into the app after completing this step.

Generating a Barcode

After you have logged in, you can create a temporary barcode that displays your remaining credit, which you can scan at the checkout when you buy something. (There are only a few merchants where you may get this).

Your card could be pre-authorized by Afterpay up to the sum of your initial installment, and the initial 25% payment must be made in full at the point of buying.

You then have the responsibility of making the subsequent payments on schedule to avoid incurring late charges.

Making a Payment

Payments can be done either via the app or via your account on the Afterpay website. You have the option of establishing regular payments or making payments individually whenever possible before the deadline.

It is important to bear in mind that BPay, bank transfers, and pre-paid cards are not approved payment methods for Afterpay.

Does Other BNPL Lenders Report to Experian?

The truth is that not all lenders are as kind as Afterpay, therefore, prior to accepting to do business with them, you have to thoroughly examine their terms and conditions and be aware of their payback plan and interest rate.

For instance, Affirm reports a few of their loans to credit bureaus, although not all of them. If you don’t make your payment on time, Affirm may report your payment history to the Experian credit bureau.

Nevertheless, Loans that do not have interest and four biweekly payments are not reported by Affirm.

Additionally, if you were just offered the choice of a three-month repayment period with no financing, your loan will not be reported to Experian.

Although Klarna, a BNPL lender, does not report timely payments, it may report any payment you skipped to the credit bureaus.

Additionally, since Klarna often runs a mild credit check prior to giving you a loan, obtaining one will not have an adverse effect on your credit score.

Does BNPL Loans Improve or Harm Your Credit?

Despite the fact that not reporting your payment history to a credit bureau may work in your favor if you skip making payments, it will not assist you establish your credit if you have an excellent track record of making your payments on time.

A payment you failed to make may be listed for up to seven years on your credit record if it is reported, which will lower your credit score.

However, these programs may sometimes be beneficial for improving credit if a “buy now, pay later” lender transmits account data to credit reporting companies like Experian and you are handling the debt properly.

Conclusion

We have come to the conclusion of this amazing article on “does Afterpay report to credit bureaus.”

The truth still remains that “Buy-now-pay-later” loans can be a great way to make large purchases at no interest.

However, some BNPL programs may negatively affect your credit score in certain circumstances.

Afterpay doesn’t harm your credit score or credit rating. Fortunately, your credit cannot be affected if you choose Afterpay.

Afterpay doesn’t report payments to credit bureaus, which can negatively affect your credit score.