All You Need To Know About Consumer Loan

It’s possible that you aren’t familiar with the phrase “consumer loan,” but chances are that you’ve had some of them before. Consumer loans are a type of loans that are designed to aid you in financing a diverse variety of purchases for consumers including everyday needs for shopping to significant life things like purchasing the home of your dreams.

The majority of the loan options available to customers fall under the category of loans for consumers. This is why it’s crucial to know how these loans function as well as how they are utilized, and the advantages they offer as a tool for financial planning, so provided you don’t misuse the benefits of these loans.

5 Common Types of Consumer Loans

If used with care When used with care, a range of consumer loan options can assist you to attain your financial goals as well as develop excellent financial management skills. These are the most popular kinds of consumer loans that you could look into at the time of your life:

Mortgage loans are used to help finance the purchase of a house or access equity that you’ve accrued in the property you currently own.

Auto loans according to Experian data supplied by the U.S. Public Interest Research Group in 2018 85 percent of all new automobile purchases and over 50 percent of used vehicle purchases require auto financing.

Credit cards: Credit accounts that roll are included in the consumer loan category. Credit card spending that is excessive could put people in a financial bind However, the responsible usage of credit cards could help manage cash flow and can even earn rewards.

Personal loans These loans are flexible and broad that allow you to pay for many different purchases.

The Benefits of Taking Out Consumer Loans

Some experts in finance advise being cautious when it comes to taking out consumer loans due to the fact that certain kinds are suited to consumer spending than constructing long-term wealth. But, a loan for consumers could provide a variety of advantages, based on your objectives and immediate financial requirements. The benefits are:

It is possible to spread the cost of spending over time. When big purchases are not feasible and would cut far into your savings Loans allow you to finance the purchase and incorporate repayments into your budget for the month.

Power of purchasing to finance the purchase of a house or other objectives in financial terms: Big purchases are often not possible without the help of consumer loans.

Potential to increase your wealth, based on the goal of the loan. For instance, mortgages let you build equity in a home. Student loans can also boost your potential to earn a living.

Financial stability comes in the form of ensuring liquidity for short-term needs When you use consumer loans to finance big purchases, you will be able to keep an emergency fund as well as cash reserves for expenses.

Do You Need a Closed or Open-Ended Consumer Loan?

Consumer loans can be constructed in two primary ways they can be structured: either as a fixed loan that is paid back over a predetermined amount of time or an account with a revolving credit which you can access at your choice.

Closed loans have fixed interest rates as well as a monthly amount for payment and a repayment period. The majority of your loans will belong to this category, such as auto loans, mortgages, or student loans.

These loans are more adaptable to accommodate your borrowing and payment requirements. This could include credit card accounts as well a line of credit for home equity as well as other options that are open-ended.

How to Compare Consumer Loan Options

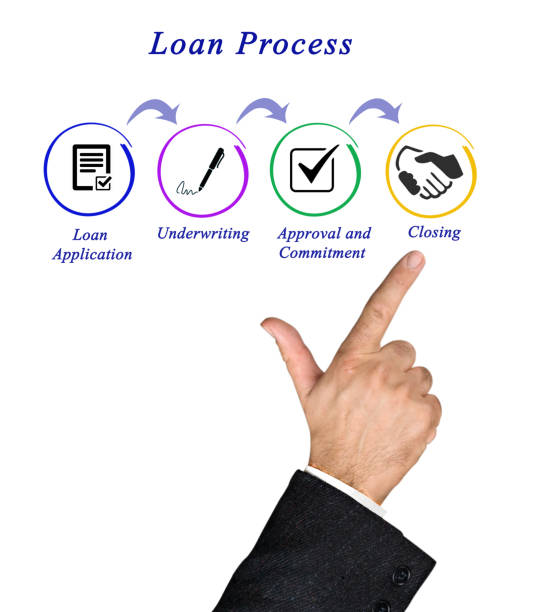

Before you take a loan, you need to read the conditions of the loan in order to make sure that it’s suitable for your requirements and is in line with the current market for lending. The most important criteria to consider include:

Rate of interest: Higher interest rates mean more monthly installments.

The duration of your repayment period determines the amount of your monthly installment.

Charges (including the annual fee for Revolving accounts) Different lenders charge different fees.

The collateral requirements, if there are any depending on your credit and other lending criteria you might require collateral to secure the loan.

Fees for early repayment. Certain loans could charge an additional fee if opt to settle the loan prior to the time frame.

If you use consumer loans in a responsible manner and manage debt responsibly as an instrument for financial management it is possible to increase the stability of your finances, improve the flow of cash, as well as leverage the power of consumer loan debt to build your net worth over time.