Can You Apply For EIDL Loan Twice?

Can you apply for EIDL loan twice? This article reveals everything you may need to know about EIDL loans as well as if you can apply for it twice.

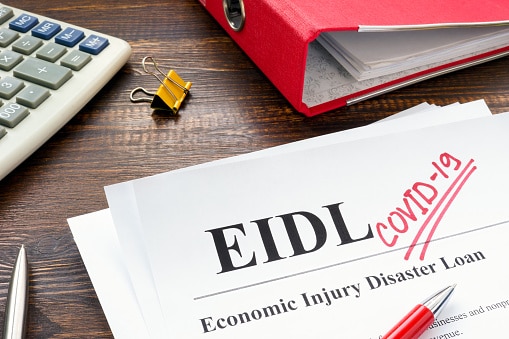

It has been a protracted crisis with the COVID-19 pandemic. Small businesses are looking for any assistance they can get as they cope with the pandemic and possibly other disasters as well.

The Small Business Administration (SBA) provides financial assistance for unexpected expenses via its Economic Injury Disaster Loan (EIDL) program.

Usually, only firms situated in regions where a proclaimed emergency, like a storm or wildfire, occurred can get EIDLs.

However, the SBA also launched a unique COVID-19 EIDL program in 2020 for firms all around the nation that were adversely affected by the pandemic.

ALSO READ:

What can EIDL loan be used for?

How to use EIDL loan for self-employed?

Can you Apply for EIDLs Loan Twice?

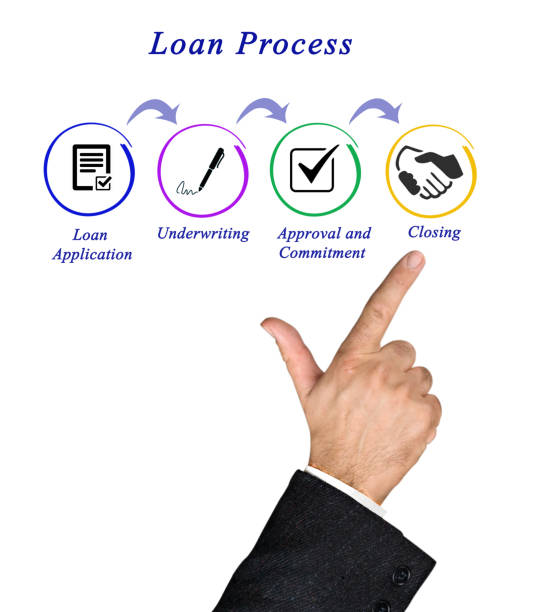

The simple answer to the question of whether you can submit an application for EIDL loan twice varies and may depend on certain factors. Below are three separate examples of the procedure in action:

Your Initial EIDL Application Was Turned Down. In this instance, you ought to have been given a justification for why your application was rejected. You can start an EIDL reconsideration request if you can allay the SBA’s worries.

You need an Additional EIDL. You are free to only submit one COVID-19 EIDL application. However, if your company has sustained extra economic harm and is situated in a region that has been labeled a catastrophe, you are permitted to submit application for a different EIDL and COVID-19 EIDL too.

You Got the COVID-19 EIDL Financing Ahead of the Increased Loan Cap in Either April 2021 or in September 2021. You can ask for a bigger quantity of loan in either situation.

In a formal sense, this is not regarded as obtaining a second loan. Instead, you’re merely benefiting from increased loan limit regulations. You will hear from the SBA if you qualify for more financing.

Is It Possible To Raise The Amount Of Your EIDL?

On occasion, the SBA raised the amount of COVID-19 EIDLs beginning with loans authorized on or after April 7, 2021.

The highest sum of loan you can get was $500,000. The highest limit has once more been raised, to $2 million as of September 8, 2021.

You can find out if you qualify by matching the new loan limit to your existing loan balance. Although there isn’t a straightforward option to apply for additional financing on the SBA’s official site, the SBA will provide you with guidelines if you decide to proceed.

What Is the Size Standards of EIDL?

Companies that are qualified for COVID-19 EIDLs must hire no more than 500 people. Along with small businesses, agricultural firms and co-ops that fulfill the same worker restrictions can additionally be eligible for a COVID-19 EIDL.

What Is the Size Standards of SBA?

SBA funding initiatives frequently use the term “size standards.” This is the largest size an organization can be and yet be considered a small business.

Every sector has a specific size standard. The SBA’s Size Standard Tool can be utilized by entrepreneurs to determine their qualification.

What Is the Size Standards of PPP?

Examining a different program put up to lessen the economic toll of the COVID-19 pandemic, borrowers who are receiving Paycheck Protection Payment (PPP) have several options for satisfying the size standards.

They have to meet one of the size standards below in order to be classified as small businesses:

- 500 workers or less

- Yearly average revenue below the relevant industry level (utilize the Size Standard Tool to determine)

- Substitute metrics centered on net worth or net earnings

How Can I Ask for an Increase of My Current EIDL Loan?

To seek an increase to your COVID-19 EIDL loan, visit the SBA official site for the conditions and the form.

The interest rates for SBA loans are often substantially lesser than those on small business private loans. Therefore, if your company requires extra capital, this can be a great option.

Nevertheless, EIDL loans cannot be forgiven. They have to be completely paid back, unlike PPP loans. Additionally, the maturity period may last up to 30 years.

If the money is not genuinely required, that is a lengthy duration for your company to pay back the loan. Therefore, it’s usually a good idea to only borrow what you require.

What Is the Maximum Loan Amounts for EIDL?

The COVID-19 EIDL restrictions for the SBA were increased as of September 8, 2021. The present cap is $2 million when determining the size of your EIDL loan.

Collateral is needed for any COVID-19 EIDL amount above $25,000, often in the shape of a comprehensive safety arrangement from the SBA. Your company’s resources are utilized as loan collateral in this situation.

The best part is that you can apply for these loan without providing a private guarantee.

ALSO READ:

How to invest in Airbnb without owning property?

How often are FHA loans denied in underwriting?

What Is the Maximum Loan Amounts for PPP?

The limit for the PPP program are substantially dissimilar from those of the COVID-19 EIDL program.

The highest loan amount for initial draw PPP loans was $10 million. The amount of the next batch of financing was reduced to $2 million.

Companies can determine their level of qualification by multiplying their monthly salary expenses by 2.5, or by 3.5 if they are in the culinary or hotel sector.

What is the Closing Date for EIDL Loan for COVID-19 Relief ?

The deadline for COVID-19 EIDL applications is December 31, 2021. Nevertheless, even after the closing date has passed, you are still permitted ask for more money.

In the event that you initially decided to borrow below the amount that was given, you have two years after the loan repayment time.

Things You Cannot Do With Your EIDL Loan

Here are a few things you are prohibited from doing with your EIDL Loan:

- Payments: EIDL money should not used to pay investors, proprietors, executives, associates, or administrators.

- Paying off principal Equity/Principal Loans: Borrowers are not permitted by the SBA to pay off equity loans.

- Direct Federal Debt: EIDL money should not be used to pay off SBA loans or any direct federal debt.

Frequently Asked Questions about EIDL Loans

Can I Apply for More Than One EIDL Loan?

You are eligible to obtain just one COVID-19 EIDL. You may be granted several EIDLs only if your company is situated in a region where a disaster has been proclaimed and you are eligible for both a COVID-19 EIDL and a regular EIDL loan.

For example, among the most frequently reported disasters in the nation is a wildfire on the West Coast. You need to provide evidence that the disaster had a negative impact on your company.

Is It Possible To Obtain Multiple EIDL Loans If You Own Multiple Businesses?

Depending on the link between the businesses, they might not be able to satisfy the SBA’s size standards.

To evaluate your basic qualification, the EIDL online application guides you through ownership and structure inquiries.

Furthermore, the SBA will receive a closer examination of the ownership structure and any possible connection problems because the same loan officer will probably assess all of your EIDL applications.

You might find it useful to consult a tax adviser to assist you deal with this problem.

Can You Submit A Second EIDL Loan Application?

The simple answer is no, The Economic Injury Disaster Loan (EIDL) program does not offer loans for COVID-19 assistance in two different phases.

This can be perplexing since there were two draw phases for the Paycheck Protection Program (PPP), a different government assistance program for small businesses, where enterprises could submit applications.

However, loans under COVID-19 are limited to just one for each company. Although it is not possible to obtain two EIDL loans, if you obtained your EIDL loan before the limit increases in April 2021 or September 2021, you could be eligible for further financing.

Does an EIDL Loan Have To Be Repaid?

Yes, regular and EIDL COVID19 loans require repayment. Nevertheless, the SBA has provided a strategy to postpone payment for a while.

Additionally, there are several EIDL advances that are set up as non-repayable grants. When a loan is repaid, EIDL loans and EIDL advances are dealt with separately.

Can EIDL Loans Be Forgiven By the SBA?

There are two parts to the present EIDL program: grants and loans. Usually, any loan that is over $2 million cannot be forgiven. The EIDL loan must be paid back. Principals are additionally exempt from the rule.

Keyword: Can you apply for EIDL loan twice

Conclusion

We have come to the end of this wonderful article on “can you apply for EIDL loan twice.”

The Small Business Administration (SBA) offers financial support for unforeseen costs through its Economic Injury Disaster Loan (EIDL) program.

The answer to the question of whether you can apply for EIDL loan twice varies and may depend on certain factors.