Loan-to-Value Calculator

A majority of all of the products we feature are made by our partners, who pay us. This could affect the products we review and the location and manner in which the product is displayed in an article. But, it doesn’t influence our assessments. Our views are entirely our own. Here’s a list of our partners, and how we earn money.

What is the loan-to-value ratio?

The ratio of the loan to value represents the sum of the loan to the value of the property. It is calculated as in percentage. If you take out a loan of $80,000 to purchase a home of $100,000, the loan-to-value is 80 percent, since you received a loan that is an 80percent of the property’s value.

From the perspective of lenders from the lender’s perspective, a mortgage with a high ratio of loan to value is considered to be riskier. The majority of mortgages with a loan-to-value ratio higher than 80% are subject to insurance on mortgages. The mortgage industry refers to loan-to-value as “LTV” for short.

How did we get here?

What’s the story behind the numbers on our loan-to-value calculator?

This calculator lets you access one of the most important elements that lenders look at when they make a mortgage loan The loan-to-value ratio. A lender is likely to evaluate your ability to pay back — which includes your score on credit, your payment history, and everything else. Most likely, however, the first thing they’ll examine is how much of a loan you’re applying for as compared to the current market price of the home.

An LTV of 80percent or less is the norm for lenders’ preferred range. They are really comfortable with the idea of lending loans with that level of LTV cushion, even though nowadays, most lenders offer loans with LTVs that are as high as 97 percent.

Let’s check out what happens to your LTV is going to turn out.

What does a calculator for loan-to-value do?

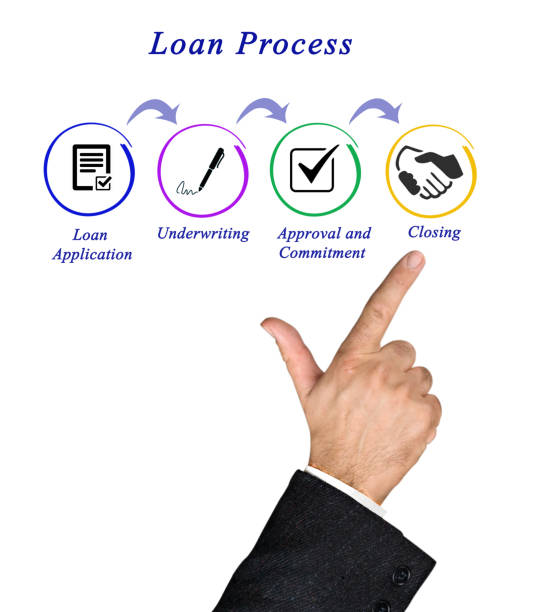

The mortgage calculator for loan-to-value from NerdWallet utilizes a straightforward, step-by-step procedure:

To begin, type:

The kind of loan you’re looking at whether it’s a refinance, purchase, etc.

The cost of purchasing the house

What’s the down payment are you willing to make

The ratio of your loan to value is instantly calculated. Anything within the 80%-90 percent range or less and you’re good to go. If you’re in the 90-97 percent range, it’s an option to get a loan that is feasible You’ll need to do more research to get the most favorable rate of interest.

How to utilize a loan-to-value mortgage calculator

It’s all about going to an institution, or submitting your application online, knowing all you’ll need to know in order to secure the most favorable conditions possible. The calculation of your loan-to-value will aid you in deciding:

The term of the loan that is the best for you. A fixed-rate loan with a 30-year term can allow you to make lower monthly payments however you’ll have to pay more in interest over the course of time. A fixed-rate mortgage with a 15-year term means that you pay less interest over the course of the loan. The rate of interest will be lower as well, but the monthly cost will be much more expensive.

An adjustable-rate mortgage could be an option, it’s worth a look. In the event that you’re in possession of a very high ratio of loan to value, you may be able to reduce your interest rates by looking into an ARM. This could be particularly beneficial for buyers of homes who plan to live in the residence for only several years.

Do I want to purchase too much of a house? A high ratio of loan-to-value could mean you’re trying to purchase more homes than the down payment you can afford. Reducing the amount you spend on your dream house could make your down payment more and reduce your LTV.

What kind of down payment do I need to make? It’s an important idea to think about. When your LTV is lower than 80 percent, you don’t be required to pay for mortgage insurance. This could save you some dollars.

Are you looking for a loan? Find the lowest rates when the lenders compete to get your company’s business

Answer a few simple questions and get personalized rates from the top lenders on NerdWallet in a matter of minutes.

How to borrow money from a mortgage

What are the most important aspects that lenders look at?

The loan-to-value ratio is one of the factors that lenders take into consideration in determining whether the applicant is eligible to receive a loan. It’s certainly among the most significant, but other aspects include:

Credit score. Your credit score does not just serve as a reference point for determining your eligibility however, it also serves as the basis upon which a lender decides the rate of interest you pay. The better your score is, the lower the interest rate. It also does the opposite as well: a lower score means that you pay more.

Down payment. The higher your down amount, the more appealing you’ll appear to a loaner. This means they’ll lower the risk of providing you with the funds to purchase a house. This is why loan-to-value plays an important role in loan decisions.

Cash flow. The amount that you’ve left after the close of your month after you have paid your regular expenses and debts — is an important indicator of your capability to pay back a mortgage.

Liquidity. In the event that you have cash stored in the banking institution, either in the form of investments or savings let your lender know that you will not only cover the closing expenses required for a loan but also have a cushion of cash essential for home ownership expenses in addition.

What should you do if your loan-to-value ratio is too high

The fact that a high ratio for loan-to-value isn’t as big an issue as it was. We’ve discussed that some conventional loans and loans insured by the FHA allow 97% LTVsas well as USDA or VA loans are offered with 100 percent LTVs every time. There are exceptions to this, but generally speaking, an increase in LTV is a sign of an increased interest rate.

Here are some suggestions to think about if you have an excessive loan-to-value ratio

Are you able to make a larger down payment? The idea of saving to make more money or getting assistance from relatives to help you make an additional down payment might not be the most appealing choice however, you’re more likely to obtain better loan terms.

Downsize your dream home. A smaller home will help your down payment last longer and will lower your LTV. It is always possible to blow out a few walls and make improvements in the future.

Be sure to get over the 80percent LTV threshold. Mortgage insurance premiums generally begin when your LTV is less than 80 percent. If you’re in the middle trying to cover the difference to surpass the 80% threshold. It will save you a lot of money over the long term.