Is Upstart Loans Legit? (Full Review)

Is upstart loans legit? This article is a full review on Upstart loans. We shall discuss everything you need to know about Upstart loans in this article.

Upstart has favorable customer care ratings, delivers quick financing for personal loans, and has reasonable interest rates.

Nevertheless, because of the charges associated with its personal loans, it’s crucial to evaluate your alternatives with those of other lenders prior to applying.

Although borrowers with high credit could be able to locate personal loans with lower charges through another source, individuals with average or no credit ratings might consider Upstart personal loans.

ALSO READ:

How to valuate a small business

Does cosigning hurt your credit?

How Upstart Functions

You are allowed to verify your rate on Upstart’s official website prior to borrowing without it affecting your credit score.

The amount of your loan will depend on your credit, earnings, and other application-related factors including your qualifications, employment history, and credit history.

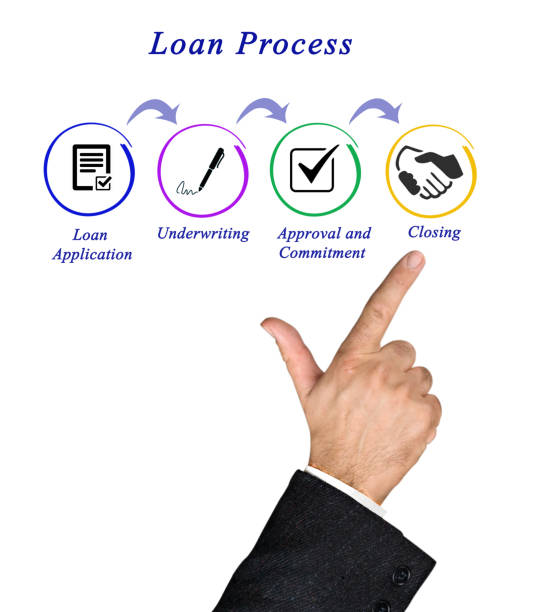

If you’re willing to apply, be aware that each lender will have a different application procedure. To connect borrowers with loan proposals, Upstart partners with financial institutions; every lender has different specifications.

To run a credit check, lenders will need data like your name, location, and Social Security number, and many lenders can also need pay slips, tax filings, college records, or SAT scores. You might have your funds the next day after being authorized for and accepting the loan.

Sometimes, loans could consume more time, and federal law stipulates that prior to financing, school loans must delay for about three working days.

Advantages of Upstart Loans

- Credit history is not necessary: If you satisfy the other criteria, Upstart will nevertheless take into account your application even if there isn’t sufficient information to calculate a FICO score for you. If you possess a credit score, you must have a 300 or higher to be approved.

- No early payment fees: You won’t receive a refund for all charges or interest you have already paid if you repaid your loan prematurely. Additionally, you will not be subject to any early payment fees, and you will pay less interest altogether.

- Loan is issued within one to two working days: If you approve your loan proposal prior to 5 p.m. ET on working days, you’ll probably have the funds the following day. It will only take 48 hours if you wait until the evening or weekend.

- Easy payback alternatives: If necessary, you can amend the deadline, divide your payment into two instalments, or make additional payments whenever.

Disadvantages of Upstart Loans

- There may be an origination charge for certain applicants: Based on your loan eligibility, origination charges might be from 0% to 8% of the loan amount. Take into account that you might have to request for more funding than you require because the amount is subtracted from the loan proceeds.

- Impose late fees: While Upstart imposes a late charge of $15 or 5% of the skipped payment, whichever is higher, other lenders don’t.

- Gives no discounts: For enrolling online, creating autopay, or already having a connection with the financial organization, many lenders provide significant discounts. These benefits are not provided by Upstart.

- Refuses to accept co-signers: You are not allowed to request a colleague or close relative to co-sign on your application if you are unable to be authorized on your own in order to boost your chances of getting approved.

- Offers just two term alternatives: You may select a three- or five-year term if you seek for a loan via Upstart. However, greater flexibility is provided by many other lenders.

Is Upstart Loans Legit?

Upstart is a reputable lender that has aided numerous individuals in obtaining the money they require. The Consumer Financial Protection Bureau (CFPB) twice reviewed Upstart’s procedure at the business’s demand and granted no action letters (NALs) each occasions. Upstart collaborates with legislators to assure the objectivity of its AI-based approach.

The goal of Upstart’s AI system is to speed up the loan application procedure for both borrowers and lenders while also accepting additional applications.

Sometimes, the online procedure is usually totally mechanized. Upstart is a fantastic choice to take into consideration if you’re a borrower looking for a quick loan with no hassles, and the organization does approve many applicants with no credit history who fulfil other qualifying requirements.

ALSO READ:

What can EIDL loan be used for?

What are the new rules for PPP loan forgiveness?

What Are the Uses of Upstart Personal Loans?

Any purpose is acceptable for Upstart’s unsecured personal loans, which range in size from $1,000 to $50,000 and have set rates between 5.31% and 35.99%.

State-specific thresholds and interest rates apply, however the typical Upstart three-year loan carries a yearly percentage rate of 18.04% and requires 36 payments of $34.27 for every $1,000 borrowed. Upstart loans can be used to do the following:

- Consolidating debts from credit cards and other sources.

- Covering the cost of moving.

- Financing home renovations.

- Paying for health bills.

- Funding a wedding.

- Establishing or growing a company

Rules, Charges, and Conditions for Upstart Personal Loans

The interest rates for Upstart loans range from 5.31% to 35.99%. These charges may likewise be added to the loans:

- An origination charge of about 8%.

- 5% of the amount that is past due in late payments, or $15, whichever is higher, for every instance.

- A $15 charge for returned checks or ACH transactions.

- If you’d prefer paper versions of your records instead of electronic ones, there is a single $10 fee.

Based on the loan conditions you choose, Upstart compels borrowers to make 36, 60, or 84 monthly payments for their debt. Nevertheless, there are no fees associated with early loan repayment.

How To Be Eligible for an Upstart Loan?

In order to be eligible for an Upstart personal loan you must:

- Reside in anyplace in the United States besides West Virginia or Iowa

- You must be at least 19 years old in Alabama and Nebraska, and at least 18 in all other states.

- Give your working email address, your real name, and your Social Security number.

- Have a U.S. bank account and a reliable means of making money.

Borrowers must have a credit score of at least 300, although they can still be approved without enough credit history to get a FICO score.

Except they are settled civil judgments or paid tax liens, your credit report cannot contain overdue or collection accounts, past-due sums, bankruptcies, or other official data from the previous one year.

Additionally, you must have had no more than six credit inquiries in the previous six months, excluding those related to mortgages, car loans, and school loans.

In order to validate your private and credit data, Upstart will get a credit report from one of the credit agencies during the application procedure.

Your educational background, professional skills, and proposed utilization of the money may additionally be requested. Your eligibility for a loan is influenced by your residence as well as your credit score.

Do You Require a Certain Credit Score?

An Upstart loan may be available to borrowers with credit scores as poor as 300, however the loan will be more expensive if your credit score is poor.

Credit score isn’t the only consideration lenders give, though. Every lender has their individual criteria for evaluating applicants, although the majority include credit history, debt-to-income ratio—the proportion of your monthly earnings that goes toward paying off debt—and costs.

Does Upstart Have a Good Customer Support?

There are various means for borrowers to get in touch with Upstart: call, text, or write an email to support@upstart.com. From 9 am to 8 p.m. EST, every day of the week, Upstart offers broad customer service if you’d rather talk to a person on the phone.

Starting at 9 am to 9 p.m. ET Monday through Friday, payment assistance is accessible beginning at 10 am to 7 pm. ET on Saturday.

Keyword: Is upstart loans legit?

Which Online Features Are Available on Upstart?

The whole application process with Upstart may be done online, from determining your rate to taking the loan, however as an extra protection measure, certain borrowers might need to have their data confirmed over the phone.

The borrower dashboard allows you to set regular payments, modify your monthly payment date, and make payments online.

Your present commitments are likewise shown on the web dashboard, as well as relevant directions or explanations regarding how your payments should be handled. You can view the amount owed and the next steps if your account is overdue.

To whom is Upstart Most suited for?

Upstart personal loans are a wonderful option for you if you are considering debt consolidation or you want funds instantly. There is no requirement for you to have a credit history, however if you have, your score must not be less than 600.

Individuals who have a reliable source of revenue, whether from a job or self-employment, can likewise qualify for Upstart.

Is It Advisable to Apply for a Loan from Upstart?

For individuals who require funds immediately to pay bills, consolidate debt, or pay any other expense, upstart personal loans are wonderful.

You are free to apply for a loan via Upstart to establish credit, regardless of if you have bad credit or adequate credit. Upstart is another option to think about if you’re seeking for a loan without a cosigner. You are eligible if you are of legal age in your state and do not reside in Iowa or West Virginia.

Keyword: Is upstart loans legit?

Conclusion

Thank you for reading this article on “is upstart loans legit.” Upstart has received an A rating from the Better Business Bureau (BBB), and the firm is registered.

Nevertheless, the overall client rating for Upstart on the BBB is merely 1.6 out of 5, although there are more than 40 reviews. However, it is a reliable firm that collaborates with financial institutions to give loans.

Although client ratings on the BBB website aren’t so fantastic, Trustpilot reviews have an astounding rating of 4.9 out of 5 stars. Upstart personal loans is an excellent alternative if you need funds instantly to cover some bills, consolidate debt or settle any other cost.