Is 5k funds legit? (Full Review)

Is 5k funds legit? This article is a full review on 5k funds based on our evaluations and researches about 5k funds.

In this article, you will learn more about 5k funds, including the pros and cons of 5k funds, as well as whether 5k funds is legit or not. So read till the end.

5KFunds is a reputable platform for loans that provides free loan evaluations from more than 100 authorized lenders in a one spot.

With 5KFunds, you can pick loans with payback terms of about 72 months and receive the loan as soon as the following working day.

A 5KFunds loan may be an excellent alternative if you need quick money because the APRs begin at 5.99%.

5kFunds was established in December 2015 and operate as Sincerely, LLC. Their headquarters is in Boca Raton, Florida.

5KFunds loans can be obtained in the majority of U.S. states apart from New York, Connecticut, Vermont, West Virginia, Alaska, and Georgia.

Giving all clients access to top-notch lending solutions is their secret to profitability.

The 5KFund website is clear and uncomplicated, and it is made to swiftly and conveniently collect data so that you can be presented with acceptable loan options.

ALSO READ:

What can EIDL loan be used for?

What Products Does 5K Funds Provide?

What 5kFunds provides are as follows:

- Installment loans

- Lines of credit

- Payday loans

Among the numerous benefits of using 5K Funds is their dedication to offering lending alternatives irrespective of credit score.

Clients that are generally underrepresented at conventional banks can likewise get lines of credit from 5KFunds.

How Does 5K Funds Function?

You can apply for personal loans online through 5K Funds and take advantage of a quick and safe application procedure.

Additionally, you can get about $35,000 from a wide range of approved lenders.

What are the Criteria for Qualification for 5K Funds?

The loan criteria for requesting a 5K Funds loan are as follows:

- You must be up to 18 years old.

- You must be a citizen of the United States of America.

- You must have a functioning bank account that allows direct deposits.

- You must have a steady source of revenue.

- You must have a working email address and a working phone number.

- There is no prerequisite credit score.

What Are 5K Funds Rates and Charges?

Lenders have different APRs, spanning from 5.99% to 35.99%. The 5KFunds website on its own is free to use, however certain lenders could impose their individual charges. The lender determines the charges, not 5KFunds.

There are no undisclosed costs or fines for early payment. Speak with your lender right away if you’re uncertain about your ability to pay back.

What Are 5K Funds Payment Policies?

The payback period might be as short as 61 days or as long as 72 months. The conditions and interest rates are chosen by the loan sponsors, not by 5KFunds.

To prevent skipped or overdue payments, certain lenders let payments be deducted directly from your account.

You need to have a formal discussion with the lender regarding payment plans and overdue payments.

Prior to consenting and approving, ensure you have studied and understood the conditions of your loan proposal.

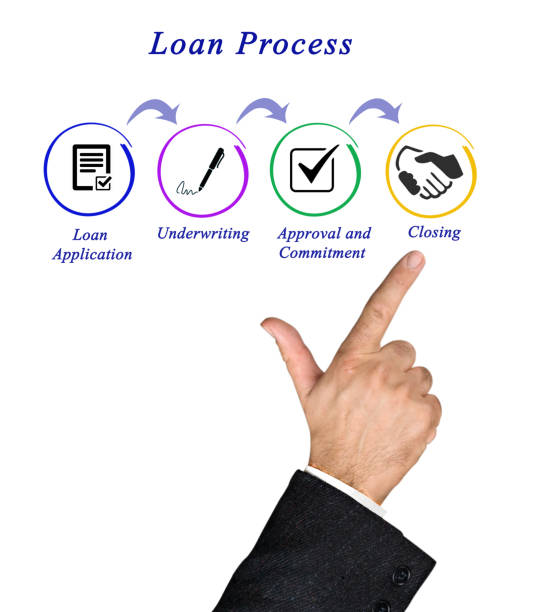

How Can I Apply for a 5K Funds Loan?

- Head over to the Website: Visit the 5KFunds website and tap “Get Started” from the menu.

- Enter your data: The loan options that perfectly meet your demands will be displayed, making it simple for you to evaluate them all in one spot in a matter of minutes.

- Get Options: The loan options that perfectly meet your demands will be displayed, making it simple to evaluate them all in a one spot in a matter of minutes.

- Evaluate and accept: Evaluate the loan options and conditions, and then accept the one that best suits you.

Clients needs to speak with their specific lenders personally after a loan is granted in order to receive specialized details.

Loans can be from $100 to $35,000 depending on the lender. Various conditions are outlined in every loan agreement. You must carefully study your contract prior to deciding to proceed.

ALSO READ:

What are the new rules for PPP loan forgiveness?

How often does an underwriter deny a loan?

How Does 5K Funds Evaluate?

5KFunds is an excellent lender that can provide loans of about $35,000. Among the many benefits of using 5KFunds to request a loan is the clear breakdown of interest rates from partner lenders.

Lenders are still primarily in charge of determining the APR rates (which begin at just 5.99%).

Considering that several lenders begin with 10.99% APR for comparable loans, these rates are appealing.

Lenders in the 5kFunds platform provide lending durations spanning from 2 to 72 months in regards to loan payback dates.

Carefully investigate loan options from lenders and check for origination charges, prepayment fines, late charges, and other costs to ensure that you are aware of all the costs associated with a 5KFunds loan.

Since 5kFunds only runs the platform and makes no guarantees regarding conditions, we advise you to carefully verify them twice prior to accepting a loan from a lender.

According to our 5kFunds assessment, there is no minimum credit score criteria; nevertheless, once you submit your loan application, the lender could run a hard credit check to see whether you qualify.

Advantages of 5k Funds

- 5KFunds has a very simple and efficient application procedure.

- 5KFunds has a speedy application procedure that is easy and completely free.

- There is no need for collateral since 5KFunds solely provides unsecured personal loans.

- The first 5KFunds application does not involve a credit check and has no impact on your credit score.

- You can get approved quickly and get your money the following working day.

- 5kFunds is a major loan platform in the United States of America.

- 5kFunds approves every kind of credit

Disadvantages of 5k Funds

- 5k Funds cannot be gotten in NY, CT, VT, WV, AK, and GA.

- 5k funds has no option for online communication.

- 5k funds has no toll-free hotline available.

Is 5k Funds Legit?

Given all our evaluations about 5k funds, we advise using 5KFunds. All loan applications are submitted via their user-friendly website.

5k Funds has a quick procedure that requires just about five minutes to finish.

Also, 5k Funds has no charges and there is a large number of loan providers in one spot.

Does 5k Funds Take Safety and Privacy Serious?

Yes. 5K Funds values the safety and privacy of their customers. As a result, all data is secured and safeguarded using 256-bit encryption in compliance with the law.

Just like most loan platforms and online lenders, 5KFunds gathers and distributes customer data to network associates.

Does 5k Funds Have a Good Customer Support?

Yes. Clients can contact 5KFunds’ customer support through phone and email. They respond to client queries in a comparatively short amount of time.

When it comes to customer support, we rate 5k Funds 70 percent, which isn’t bad at all.

Does 5k Funds have Benefits and Bonuses?

Many lenders exceed your expectations when you apply for a loan in order to streamline the application procedure or to provide benefits.

This may take the shape of rate reductions for establishing scheduled payments or loyalty reductions for borrowing from the bank where you hold your checking account.

Additionally, lenders can provide smartphone apps that make it simple to handle your loan, provide resources for planning, or teach you how to handle your funds.

5k Funds is straightforward and may not instantly provide any of these benefits or incentives.

It is very important to note that there is no assurance that you will be paired to a lender who offers flexible loans or has a nice website or app, though the lenders it pairs you with could offer a few of these advantages.

Frequently Asked Questions on “Is 5k Funds Legit?”

Here are some of the frequently asked questions about 5k Funds.

Is the Data I Provide About Myself Safe with 5k Funds?

5KFunds values your privacy and uses 256-bit bank-level SSL encryption to safeguard the private data you provide.

How Much Does Using 5KFund Cost?

There are no charges associated with using 5k funds, nevertheless, different lenders can impose application and origination costs.

When Must I Pay Back My Loan?

Depending on the lender, loan payback durations might range from 61 days to 72 months.

Why is 5KFunds a Good Loan Evaluation Platform?

5KFunds can provide unsecured loans of about $35,000 and collaborates with more than 100 different lenders.

After you have been approved, you will have your funds instantly transferred into your bank account the following working day. This is one of the reasons why 5K funds is unique.

How Should I Spend the Loan?

You are free to spend your 5KFunds personal loan on whatsoever you wish. Just make sure you are able to repay the loan before the end of the repayment date.

Who Should I Speak with Regarding Late Payments?

If you are having trouble paying back your loan, get in touch with the lender personally.

Lenders have different late payment fines. If a fine is specified in a lender’s contract, it could be imposed instantly.

How Much Is 5K Funds APRs?

Using the 5KFunds platform is completely free. Nevertheless, lenders’ APRs differs, ranging from 5.99% to 35.99%.

Conclusion

Thank you for reading this auricle on “is 5k funds legit?”

The loan application procedure offered by 5KFunds is swift and practical if you require immediate money, whether it be an unsecured loan, a payday loan, or a loan for debt consolidation.

Although we desire to see the 5kFunds broaden the variety of loan amounts it offers and include instructional materials to its website, 5KFunds is a great option for nearly all persons who is searching for an innovative type of financing because of its straightforward application procedure, quick financing periods, and flexible conditions.

You will enjoy 5KFunds’ lenient eligibility standards and open borrower-lender pairing features if you’re seeking for a fast and convenient solution to finance nearly any private venture.