Installment Loans vs Home Equity Loans – What’s The Difference?

What’s The Difference Between Installment Loans vs Home Equity Loans?

In this article, we are going to discuss the difference between Installment Loans and Home Equity Loans, their benefits, and how they work.

When it comes to getting a loan to help with home repairs or other personal expenses, you might be apprehensive about which type is the better option. After all, both installment and home equity loans have their advantages and disadvantages. Here’s an overview of the differences between installment loans vs. home equity loans.

When it comes to making big financial decisions, most people prefer to do their homework and consult a qualified financial advisor before making any major financial decisions. When it comes to home mortgage loans, the differences between an HEO loan and an installment loan can be pretty subtle. Let’s take a look at what these terms mean, as well as their different implications.

What is an Installment Loan?

A typical installment loan is made over a period of time with a set interest rate that is added to the total you owe at the end of each pay period. The length of the loan can range from 30 days to 5 years. The interest rate attached to the loan means you’ll pay it regardless of how successful your home is in selling. When you make an installment loan, there’s no equity built into the house. Instead, you borrow money against the property you currently live in. This is called an equity loan. The loan may be a consolidation loan or a new loan. If the loan is a new loan, it is sometimes called a cash-out loan. As time passes, interest rates will rise and fall based on market conditions. If interest rates rise above certain thresholds, it could affect your ability to refinance your loan at a later date.

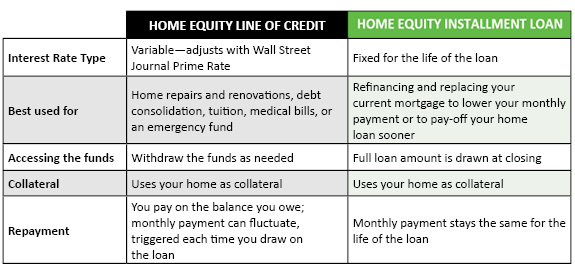

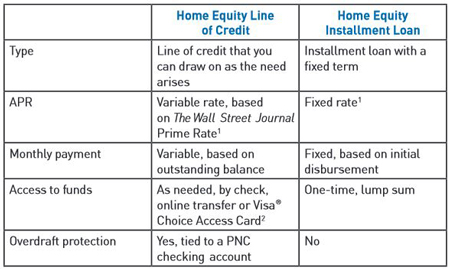

What is a Home Equity Loan?

A home equity loan is the same thing as a home equity loan, only you borrow against your house instead of a commercial property. There are many types of home equity loans, but the most common are diverter-offer loans and direct investment loans. A diverter-offer loan is when you first buy a home and then sell it back to the original lender. You get to keep the difference between the purchase price and the amount you loan the bank. If you buy a home with a high-interest rate, you may be able to get the lender to diverter-offer you and give you a lower rate. A direct investment loan is when the lender owns the underlying property. The lender will make the loan, but you will actually own the house. You will have to pay taxes on it like any other house you own. You can sell the house and make some money or use it as a vacation home.

How Installment Loans Work

You can usually make an installment loan through a commercial lender. Your loan will be interest-free for the first 30 days and you will be required to pay interest on the remaining months of the loan. Before the lender can start making payments towards the interest, you must give the lender your security interest (usually a bond). The lender will then start the process of taking out a mortgage. In order for the lender to start the process of getting your loan paid off, you must put up collateral. If the full amount of the loan is pledged as collateral, the lender will have to wait until the collateral is sold before making the payment. If the lender does not have the funds to make the payment when it is due, a foreclosure will take place. During a foreclosure, you will lose your home. If a foreclosure goes through, the lender will usually send you a bill for the amount of the loan that is not charged-off. Contest the bill and keep fighting it until you are successful. If you are successful, the bill will be sent back to the lender and you will have to start the whole process all over again. You will most likely end up paying the bill even if you are not successful in fighting it.

How Home Equity Loans Work

These loans work very similarly to a traditional mortgage, but instead of a mortgage, the lender makes an equity loan against your home. You can apply for a home equity loan with your local bank or a credit union. The amount you can borrow will be based on your credit score and the value of your home. The loan can be for a fixed amount or vary based on your ability to pay. The amount you borrow is usually tax-free. The loan will be repaid when your home equity is high enough to cover the interest. The repayment period may be as little as one month or as long as five years. When you make a home equity loan, you’ll generally be required to put up collateral to secure the loan. If the full amount of the loan is pledged as collateral, the lender will have to wait until the collateral is sold before making the payment. If the lender does not have the funds to make the payment when it is due, a foreclosure will take place. During a foreclosure, you will lose your home. If a foreclosure goes through, the lender will usually send you a bill for the amount of the loan that is not charged-off. Contest the bill and keep fighting it until you are successful. If you are successful, the bill will be sent back to the lender and you will have to start the whole process all over again. You will most likely end up paying the bill even if you are not successful in fighting it.

How Installment Loans Are Calculated

The main difference between a short-term loan and short-term security and a long-term loan is the length of the term. A short-term loan is generally for a month or a few months, while short-term security is good for 30 days. The main difference between a long-term loan and long-term security is the amount the lender is willing to risk on the loan. The amount of the loan is calculated using three simple but important factors: the original loan amount divided by the current market value of the collateral (the home). The monthly interest rate is also a function of the market value of the collateral at the time of loan application. The amount of loan repayment is also determined by the market value of the collateral at the time of loan repayment.

When Is the Best Time to Apply for an Installment Loan?

The best time to apply for an installment loan is during periods of high property appreciation. If you are planning on staying put, a home equity loan is a good option. It doesn’t lose value when your house sells, so you won’t be paying extra every time it is appraised. Also, some home equity loan programs offer a bonus if you make a certain number of payments before your loan is paid off. If you are thinking of buying a home, now is the time to start your research. The best time to get a mortgage is usually near the time of purchase. The best time to buy a house is usually the lowest price period. And, the best time to get a credit score is usually near the time of application.

Pros and Cons of Each Type of Loan

As you can see, there are plenty of pros to both types of loans. Both cash-out and home equity loans come with perks such as zero% interest and lower monthly fees, but they are different enough to warrant consideration. Here are a few things to consider when deciding which type of loan is best for your situation:

Home Equity Loan vs. Installment Loan: What’s The Difference?

– Duration: Home equity loans last longer than installment loans, but they do come with a higher interest rate. You should think about how long you want to pay off your loan before you make a decision about which type of loan is best for you.

– Timing: The best time to take an installment loan is usually during the first few months after a home purchase. The best time to take a cash-out loan is usually near the time of application. The best time to buy a house is usually at or near the time of purchase.

Conclusion

In the end, the decision between a home equity loan or an installment loan is really down to you. Both types of loans offer similar benefits, and it’s up to you to decide which type of loan is right for your financial situation. If you are looking for a short-term loan, an installment loan is a great option. They come with no interest and a lower monthly fee than a cash-out loan. But, if you are looking for a long-term loan, a home equity loan is the best option. They come with no interest and a lower monthly fee than an installment loan.