Does a Secured Loan Affect Remortgaging?

Does a secured loan affect remortgaging? This articles explains everything you need to know about secured loans and remortgaging.

What is a Secured Loan?

A secured loan is also referred to as a homeowner loan or second charge mortgage. It is affixed to your property, providing your creditor with further protection.

With a lower degree of risk from the creditor’s perspective, they could have greater ease granting you bigger loans at a reduced interest rate.

Nevertheless, if you fail to keep up with your payments, the creditor might compel you to sell your property to recover their funds back. Do not forget, this is often a last-ditch effort.

The reason it is referred to as a “second charge” is because it takes second place to your mortgage which is your first charge.

For example, if a residence were to be sold, the initial person to recover their funds back will be your mortgage company.

Then the remainder of the profits would then be used to pay off the loan. When both are completely compensated, any money that is left over would be yours.

ALSO READ:

Does klarna accept chime bank?

How to start online fish table business

How Secured Loans Function

Secured loans enable borrowers to receive a one-time payment of money to pay for anything, including home renovation initiatives and the acquisition of a vehicle or house.

These loans are normally available through conventional banks, credit unions, mortgage brokers, car lots, and online loans.

Despite the fact that secured loans present less danger to creditors, a rigorous credit check is typically performed during the application process.

Although certain creditors permit preapproval with only a light credit inquiry. And, even as the amounts on secured loans incur interest just like conventional loans, reduced annual percentage rates (APRs) are available to borrowers than those offered by unsecured alternatives.

After being eligible for a secured loan, a mortgage is put on the borrower’s collateral by the creditor.

This enables the creditor to take possession of the collateral if the borrower fails to make loan payments.

The collateral must have a worth that exceeds or is equivalent to the remaining loan balance to increase the creditor’s likelihood of getting its money back.

What is Remortgaging?

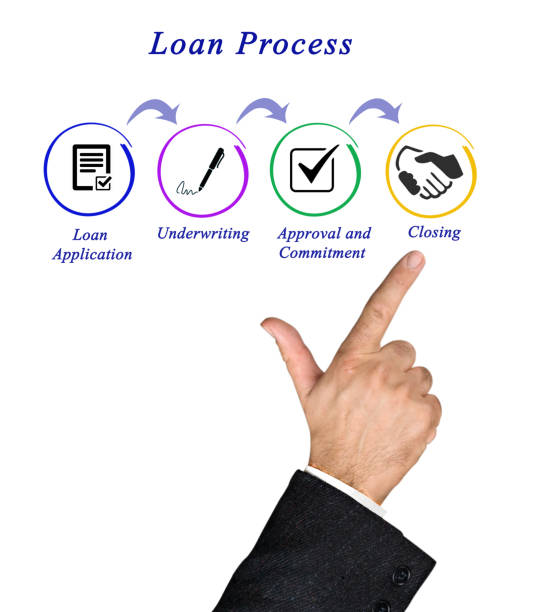

Comparatively, remortgaging is typically a four to eight weeks process of switching to a different creditor with your current property.

This could be to obtain a better bargain than what your present creditor can provide for your mortgage.

ALSO READ:

How to cast vision in business

Does a Secured Loan Affect Remortgaging?

We have received numerous questions pertaining “does a secured loan affect remortgaging” from our reading audiences. We have dedicated this paragraph to answer the question in details. So keep reading!

If your house has already been used as collateral for a secured loan, remortgaging could still be an option for you.

It can actually be a wise choice if your mortgage period is over and the rate has been changed to a typical flexible one.

In this situation, remortgaging could be appropriate as you’ll have the option to switch at no extra cost.

Is It Possible for Me Remortgage Even Though I Have a Secured Loan?

The answer is yes, if your property is backed by a secured loan, you could be able to remortgage, however, you might have fewer choices.

It is either you borrow additional funds to pay off the loan or you do not combine the loan with your mortgage payments.

ALSO READ:

How to beat a possession of stolen property charge

When Should You Pick a Secured Loan?

Certain individuals choose secured loans over remortgaging. Possible reasons for this could be:

- Not being qualified to remortgage.

- Paying penalties for early repayment if you switch as quickly as possible.

- Already profiting from a favorable mortgage agreement.

Regardless of the reason, ensure you determine if a mortgage loan is not inexpensive prior to moving forward.

Keep in mind that loan repayments are required in addition to your current mortgage. You should also think about the danger associated if you are unable to make your payments.

ALSO READ:

Can someone survey my property without my permission?

Why Would Anyone Want to Remortgage?

You could be curious to know the reason why someone who already has a secured loan would want to remortgage. Just maybe:

- Their mortgage arrangement is over and they are free to change at no cost.

- To change to a more affordable interest rate.

How You Should Handle Your Secured Loan

You have two options for using your secured loan if you remortgage:

- Remortgage and increase borrowing to pay off the loan

- Remortgage and continue making separate loan payments

Pay Off the Loan

If you remortgage, you can consider taking out a larger loan to repay your secured loan. How much you may borrow will be based on your specific situation and the standards of the creditor.

For instance, the creditor could examine your earnings and expenses, how much your property is worth, and the amount of equity you own.

If you wish to pay off your loan when you remortgage, there will be just one creditor you have to pay every month. Spending is now simpler as a result.

Another advantage is that your mortgage’s interest will be probably lesser compared to your secured loan.

Nevertheless, borrowing bigger entails you will be paying for a lengthier period of time. Due to this, the total amount of interest you will pay might be higher at the end of the day.

Prior to continuing, make sure you can repay the monthly installments before borrowing. They could be more expensive than what you’re already paying.

ALSO READ:

Can I use a prepaid credit card at redbox?

Keep the Loan

You are not required to clear your homeowner loan if you remortgage. You can do so only after you make a profit.

It can be paid in addition to your new mortgage individually. This could be the situation, if you cannot be able to take out extra loans, for instance.

Take note that it’s possible that certain creditors won’t be as eager to remortgage your property if it is tethered to a loan.

Therefore, ensure to ascertain the creditor’s position on this issue prior to applying. This could stop you from requesting for an improper mortgage.

Keep in mind that if you separate your loan, your creditor will consider your repayments during your remortgage application process. The interest rate you’re given may change as a result.

Moreover, there could be charges from your new mortgage supplier for the additional administrative work associated if you possess a secured loan.

Although certain suppliers might pay for this, others will demand payment from you. Therefore, prior to applying, it is important to inquire with the creditor about this.

Advantages and Disadvantages of Remortgaging

Although remortgaging could be a wise financial decision for several homeowners, it’s not appropriate for everybody.

Those who presently have a stellar mortgage arrangement or whose share of their home ownership is lower than 25% most likely won’t be able to see an agreement in the remortgage industry.

Those that have relatively tiny mortgages or poor credit standing could see the procedure for requesting and paying for a remortgage as something that is not worth investing time or funds.

Nevertheless, if you do not fit into any of these classifications, it’s crucial to cautiously balance the advantages and disadvantages before starting the remortgage procedure.

Below are some Advantages of Remortgaging:

- Being able to borrow money with less interest.

- Possibility of borrowing money from the equity in your property.

- The chance to change to a package that is better fitted to your financial circumstances.

- Having the choice to combine all of your loans into one manageable monthly payment.

Below are some Disadvantages of Remortgaging:

- Spreading out your loan over a lengthier period of time raises the total expense.

- When your house is pledged as security, it may be seized if you are unable to make the payments.

- Remortgages are subject to charges, which could negate any advantages you may obtain from bargaining a reduced rate on your loan.

- It may take many weeks to finish the remortgage process, therefore, you will have to be dedicated to the process until it’s completed.

Conclusion

We strongly believe that this article on “does a secured loan affect remortgaging” has explained to you in details all you need to know about secured loans and remortgaging.

Before requesting for a remortgage, examine if taking this action will actually improve your financial circumstance. If not, perhaps now isn’t the best time to change your mortgage package.